Is Mr. Cooper Group Inc. (COOP) A Good Stock To Buy?

The market has been volatile in the fourth quarter as the Federal Reserve continued its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds' movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Mr. Cooper Group Inc. (NASDAQ:COOP) and find out how it is affected by hedge funds' moves.

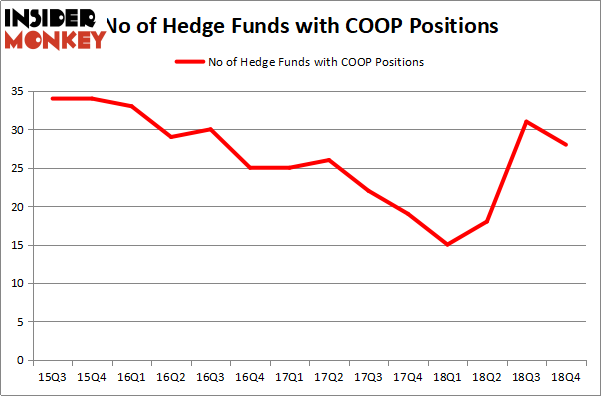

Mr. Cooper Group Inc. (NASDAQ:COOP) has seen a decrease in enthusiasm from smart money recently. COOP was in 28 hedge funds' portfolios at the end of the fourth quarter of 2018. There were 31 hedge funds in our database with COOP holdings at the end of the previous quarter. Our calculations also showed that COOP isn't among the 30 most popular stocks among hedge funds.

Hedge funds' reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn't keep up with the unhedged returns of the market indices. Our research has shown that hedge funds' large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that'll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That's why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We're going to analyze the recent hedge fund action surrounding Mr. Cooper Group Inc. (NASDAQ:COOP).

What have hedge funds been doing with Mr. Cooper Group Inc. (NASDAQ:COOP)?

Heading into the first quarter of 2019, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from the previous quarter. By comparison, 15 hedge funds held shares or bullish call options in COOP a year ago. So, let's find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Diamond Hill Capital held the most valuable stake in Mr. Cooper Group Inc. (NASDAQ:COOP), which was worth $86.2 million at the end of the fourth quarter. On the second spot was Greywolf Capital Management which amassed $63.1 million worth of shares. Moreover, Appaloosa Management LP, Rubric Capital Management, and Serengeti Asset Management were also bullish on Mr. Cooper Group Inc. (NASDAQ:COOP), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: 999. One hedge fund selling its entire position doesn't always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don't think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Diamond Hill Capital).

Let's go over hedge fund activity in other stocks - not necessarily in the same industry as Mr. Cooper Group Inc. (NASDAQ:COOP) but similarly valued. These stocks are CSG Systems International, Inc. (NASDAQ:CSGS), Sykes Enterprises, Incorporated (NASDAQ:SYKE), Hollysys Automation Technologies Ltd (NASDAQ:HOLI), and Sleep Number Corporation (NASDAQ:SNBR). This group of stocks' market valuations resemble COOP's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position CSGS,15,133495,1 SYKE,16,39663,0 HOLI,15,70270,-1 SNBR,18,75967,4 Average,16,79849,1 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $80 million. That figure was $420 million in COOP's case. Sleep Number Corporation (NASDAQ:SNBR) is the most popular stock in this table. On the other hand CSG Systems International, Inc. (NASDAQ:CSGS) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Mr. Cooper Group Inc. (NASDAQ:COOP) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately COOP wasn't nearly as popular as these 15 stock and hedge funds that were betting on COOP were disappointed as the stock returned -28.2% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

Billionaire Ken Fisher’s Top Dividend Stock Picks

30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index