MSC Industrial (MSM) Buys Engman-Taylor to Expand Metalworking

MSC Industrial Direct Company, Inc. MSM acquired a Wisconsin-based distributor of metalworking tools and supplies, Engman-Taylor.

Engman-Taylor will continue to operate under its current name after becoming a part of the MSC Industrial company. The buyout is likely to be roughly neutral to the company’s earnings in fiscal 2022 while modestly accretive to fiscal 2023 earnings.

The acquisition will strengthen MSC Industrial’s metalworking business. Engman-Taylor’s capabilities, skill and focus on serving customers complement MSM’s commitment to aid customers in solving their mission-critical challenges on the plant floor.

Engman-Taylor’s two service locations in Wisconsin, two in Illinois and one in North Carolina align well with MSM Industrial’s national reach. Engman-Taylor will provide customers access to MSM’s more than 2 million products offering, inventory management and other supply chain solutions.

MSC Industrial, a leading North American supplier and distributor of Metalworking and Maintenance, Repair and Operations to industrial customers, consistently focused on acquiring new companies to expand its product offering. MSM enables these companies to maintain their identities and customer relationships while offering its wide portfolio of products and solutions.

MSC Industrial’s second-quarter fiscal 2022 earnings beat the Zacks Consensus Estimate while sales missed the same. Both the bottom and the top line increased year over year. The company’s Implant business continues its strong momentum representing approximately 9% of company sales in the fiscal second quarter.

The company was awarded a five-year contract to service 10 U.S. Marine core bases across the Continental United States, Hawaii and Japan. This new contract will fuel MSM’s revenues in the remaining part of fiscal 2022 and fiscal 2023.

MSC Industrial delivered $6 million of savings in the fiscal second quarter and it continues to expect $25 million in cost savings in fiscal 2022. The company is focused on achieving at least $100 million in total cost savings by the end of fiscal 2023. MSM is improving its margin and operating leverage through Mission Critical productivity initiatives.

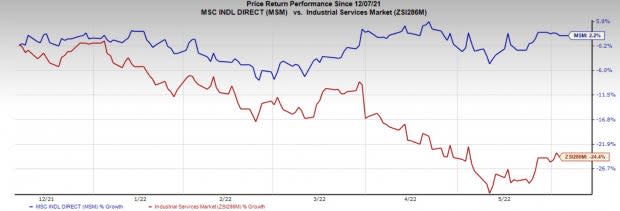

Price Performance

MSC Industrial’s shares have gained 2.2% in the past six months against the industry’s decline of 24.4%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

MSC Industrial currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Industrial Products sector are Graphic Packaging Holding Company GPK, Myers Industries MYE and Packaging Corporation of America PKG, each flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Graphic Packaging has an estimated earnings growth rate of 86.8% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 7.6%.

Graphic Packaging pulled off a trailing four-quarter earnings surprise of 7.2%, on average. The company’s shares have appreciated 14.8% in a year.

Myers Industries has an expected earnings growth rate of 67% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 27% in the past 60 days.

MYE has a trailing four-quarter earnings surprise of 20.1%, on average. Myers Industries’ shares have gained 13% in the past year.

Packaging Corporation has an expected earnings growth rate of 16.2% for 2022. The Zacks Consensus Estimate for the current year’s earnings rose 4.2% in the past 60 days.

PKG has a trailing four-quarter earnings surprise of 19.6%, on average. Packaging Corporation’s shares have gained 4% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Packaging Corporation of America (PKG) : Free Stock Analysis Report

MSC Industrial Direct Company, Inc. (MSM) : Free Stock Analysis Report

Graphic Packaging Holding Company (GPK) : Free Stock Analysis Report

Myers Industries, Inc. (MYE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research