MSCI Q1 Earnings Beat Estimates, Recurring Subscriptions Up Y/Y

MSCI Inc.’s MSCI first-quarter 2022 adjusted earnings of $2.78 per share beat the Zacks Consensus Estimate by 1.46% and increased 17.8% from the year-ago quarter.

Shares were up 0.72% in pre-market trading following the announcement.

Operating revenues improved 17% year over year to $559.9 million and beat the consensus mark by 0.17%.

This year-over-year growth was driven by 18.4% and 14.5% rise in recurring subscriptions (71.4% of revenues) and asset-based fees (25.9% of revenues), respectively. Non-recurring revenues (2.7% of revenues) increased 8.2% year over year to $15.1 million.

At the end of the reported quarter, average assets under management were $1.21 trillion in ETFs linked to MSCI indexes. Total retention rate was 95.9% in the quarter under review.

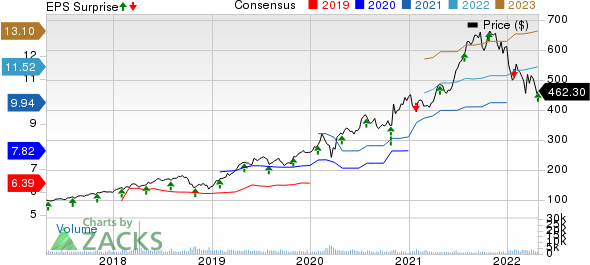

MSCI Inc Price, Consensus and EPS Surprise

MSCI Inc price-consensus-eps-surprise-chart | MSCI Inc Quote

Quarter Details

In the first quarter, Index operating revenues improved 13.1% year over year to $330.8 million, driven by higher recurring subscription revenues and asset-based fees.

Growth in higher recurring subscription revenues was driven by growth from market-cap weighted index products and strong growth from factor, ESG and climate index products.

Asset-based fees’ growth was primarily driven by an increase in revenues from ETFs linked to MSCI equity indexes as a result of higher average AUM in the same. This was partially offset by a decline in average basis point fees.

Moreover, non-ETF indexed funds linked to MSCI indexes contributed to the increase in revenues.

Analytics operating revenues improved 4.3% year over year to $139.8 million. The growth was driven by higher recurring subscription revenues from both Multi-Asset Class and Equity Analytics products.

ESG and Climate segment’s operating revenues surged 49.7% from the year-ago quarter to $52 million, primarily driven by strong growth from recurring subscriptions related to Ratings, Climate and Screening products.

All Other revenues, which primarily comprise of the Real Estate operating segment, were $37.4 million, up 117.7% year over year.

Adjusted EBITDA increased 15.2% year over year to $318.5 million in the reported quarter. Adjusted EBITDA margin contracted 90 basis points (bps) on a year-over-year basis to 56.9%.

Total operating expenses increased 20.9% on a year-over-year basis to $271 million. Adjusted EBITDA expenses were $241.4 million, up 19.6%, primarily reflecting higher compensation and benefits costs related to continued investments to support growth, including increased headcount in technology, research and client coverage.

Operating income improved 13.6% from the year-ago quarter to $289 million. However, operating margin contracted 160 bps on a year-over-year basis to 51.6%.

Balance Sheet & Cash Flow

Total cash and cash equivalents, as of Mar 31, 2022, were $679.3 million compared with $1.4 billion as of Dec 31, 2021.

Total debt was $4.2 billion as of Mar 31, unchanged sequentially. Total-debt-to-adjusted-EBITDA ratio (based on trailing twelve-month-adjusted EBITDA) was 5.5 times, much higher than management’s target range of 3-3.5 times.

Net cash provided by operating activities was $244.2 million in the fourth quarter, up 13.3% year over year. Free cash flow was $228.9 million, up 11.6% year over year.

MSCI bought shares worth $772.7 million during the reported quarter. Notably, $794.4 million are outstanding under MSCI’s share-repurchase authorization as of Apr 25, 2022. The company paid out dividends worth $84.7 million in the first quarter.

Guidance

For 2022, MSCI expects total operating expenses of $1.075-$1.115 million. Adjusted EBITDA expenses are expected between $975 million and $1.005 billion.

Interest expenses are expected to be roughly $162 million.

Capex is expected to be $60-$70 million.

Net cash provided by operating activities and free cash flow are expected to be $1.120-$1.160 billion and $1.050-$1.100 billion, respectively.

Zacks Rank & Stocks to Consider

Currently, MSCI has a Zacks Rank #3 (Hold).

MSCI shares have underperformed the Zacks Computer & Technology sector year to date. While MSCI shares have decreased 24.6%, the Computer & Technology sector dropped 20.4%.

Camtek CAMT, CDW CDW and Fabrinet FN are some better-ranked stocks that investors can consider in the broader sector. All the three stocks has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

CAMT shares are down 31.1% compared with sector’s decline of 21.7%. The company is set to report first-quarter 2022 on May 12, 2022.

CDW shares are down 16.6% year to date. The company is set to report first-quarter 2022 results on May 4.

Fabrinet shares are down 16% year to date. FN is set to report third-quarter fiscal 2022 results on May 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Camtek Ltd. (CAMT) : Free Stock Analysis Report

MSCI Inc (MSCI) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report

CDW Corporation (CDW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research