How Much Did Titan International's(NYSE:TWI) Shareholders Earn From Share Price Movements Over The Last Three Years?

Titan International, Inc. (NYSE:TWI) shareholders will doubtless be very grateful to see the share price up 93% in the last quarter. But that is small recompense for the exasperating returns over three years. Tragically, the share price declined 70% in that time. So it is really good to see an improvement. After all, could be that the fall was overdone.

View our latest analysis for Titan International

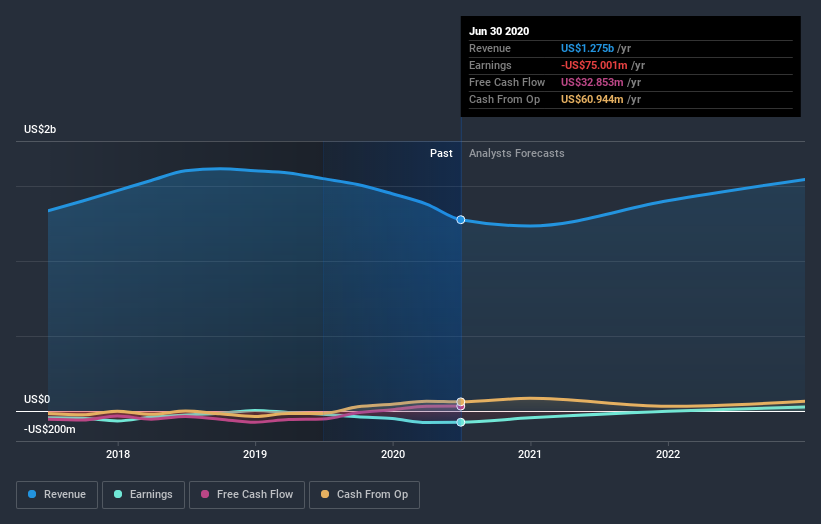

Titan International isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years Titan International saw its revenue shrink by 3.2% per year. That's not what investors generally want to see. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 19% per year. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Titan International's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Titan International provided a TSR of 22% over the year. That's fairly close to the broader market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 5% over the last five years. We're pretty skeptical of turnaround stories, but it's good to see the recent share price recovery. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Titan International .

But note: Titan International may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.