How Much is Skandinaviska Enskilda Banken AB (publ.)'s (STO:SEB A) CEO Getting Paid?

Johan Torgeby became the CEO of Skandinaviska Enskilda Banken AB (publ.) (STO:SEB A) in 2017. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at other big companies. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

Check out our latest analysis for Skandinaviska Enskilda Banken AB (publ.)

How Does Johan Torgeby's Compensation Compare With Similar Sized Companies?

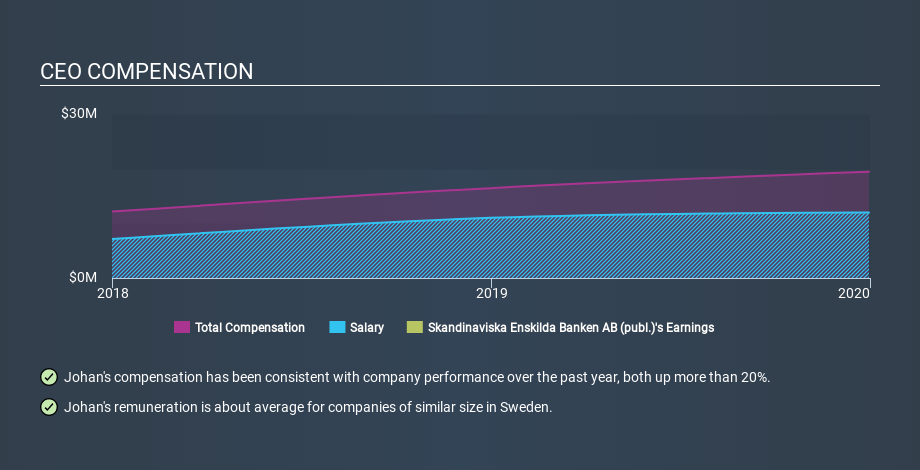

At the time of writing, our data says that Skandinaviska Enskilda Banken AB (publ.) has a market cap of kr145b, and reported total annual CEO compensation of kr19m for the year to December 2019. Notably, that's an increase of 18% over the year before. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at kr12m. We looked at a group of companies with market capitalizations over kr80b and the median CEO total compensation was kr18m. (We took a wide range because the CEOs of massive companies tend to be paid similar amounts - even though some are quite a bit bigger than others).

Next, let's break down remuneration compositions to understand how the industry and company compare with each other. On a sector level, around 59% of total compensation represents salary and 41% is other remuneration. Skandinaviska Enskilda Banken AB (publ.) does not set aside a larger portion of remuneration in the form of salary, maintaining the same rate as the wider market.

So Johan Torgeby receives a similar amount to the median CEO pay, amongst the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance. You can see a visual representation of the CEO compensation at Skandinaviska Enskilda Banken AB (publ.), below.

Is Skandinaviska Enskilda Banken AB (publ.) Growing?

Over the last three years Skandinaviska Enskilda Banken AB (publ.) has seen earnings per share (EPS) move in a positive direction by an average of 13% per year (using a line of best fit). It achieved revenue growth of 7.0% over the last year.

This demonstrates that the company has been improving recently. A good result. It's nice to see a little revenue growth, as this is consistent with healthy business conditions. Shareholders might be interested in this free visualization of analyst forecasts.

Has Skandinaviska Enskilda Banken AB (publ.) Been A Good Investment?

With a three year total loss of 21%, Skandinaviska Enskilda Banken AB (publ.) would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

Johan Torgeby is paid around the same as most CEOs of large companies.

We like that the company is growing EPS, but we cannot say the same about the lacklustre shareholder returns (over the last three years). Considering the the positives we don't think the CEO pays is too high, but it's certainly hard to argue it is too low. Shifting gears from CEO pay for a second, we've picked out 1 warning sign for Skandinaviska Enskilda Banken AB (publ.) that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.