A Multi-Factor, Small-Cap ETF Opportunity to Enhance Returns

As investors look to opportunities in an extended bull market environment, consider small capitalization stocks for their growth potential and smart beta ETF strategies to diversify risks and potentially enhance returns. On the recent webcast (available on demand for CE Credit), Harness the Power of Multi-Factor Investing , Marc Chaikin, CEO of Chaikin Analytics, explained that factor investing is simply any investment theme relating to a group of securities that can help explain their risk and return, including size, value, quality, momentum and volatility, among others. However, Chaikin warned that single factors exhibit a highly cyclical nature from year to year, which leaves market timing hard to predict. Consequently, investors may combine the various factors to create a more diversified solution to enhance returns over time.

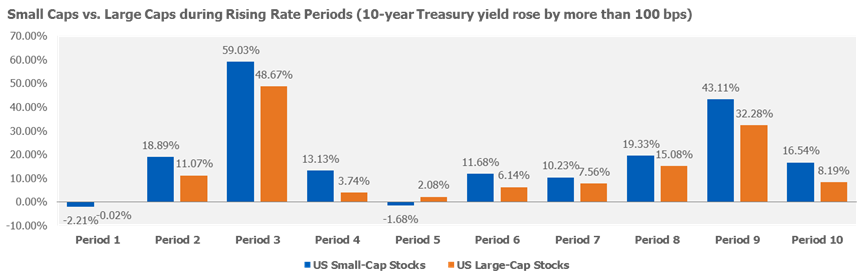

"While factor performance has historically been cyclical, most factor returns generally are not highly correlated with one another, so investors can benefit from diversification by combining multiple factor exposures," Chaikin said. Salvatore Bruno, Chief Investment Officer and Managing Director of IndexIQ, also argued for the benefits of small-cap exposure, such as the category's historical outperformance to large-caps over time and the ability to recover faster from market downturns. Furthermore, small-caps have also outperformed large-caps during periods of rising rates since higher rates typically accompany periods of higher growth and small caps have historically grown faster as they grow off a smaller base. Smaller companies also have lower debt, so earnings are less impacted by rising rates.

ETF investors seeking a way to target the growth potential of small-caps and a smart beta strategy to diversify risks may look to the IQ Chaikin U.S. Small Cap ETF (CSML) , which tries to reflect the performance of the Nasdaq Chaikin Power US Small Cap Index. The underlying index incorporates the so-called Chaikin Power Gauge that combines four primary factors, including value, growth, technical and sentiment. The value factor includes screens like LT debt to equity ratio, price to book value, return on equity, price to sales ratio and free cash flow. Technical factors cover price trend, price trend rate of change, relative strength vs. market and volume trend. Growth factors include earnings growth, earnings surprise, earnings trend, projected P/E ratio and earnings consistency. Lastly, the sentiment factor screens for earnings estimate trend, short interest, insider activity, analyst ratings and industry relative strength. "The multi-factor approach - Chaikin Power Gauge - that CSML employs may help to diversify portfolio risk and seeks to select stocks with the potential to provide enhanced returns over time," Bruno said. Financial advisors who are interested in learning more about multi-factor, smart beta strategies can watch the webcast here on demand.Read more on ETFtrends.com