Murphy Oil (MUR) Beats Q2 Earnings and Revenue Estimates

Murphy Oil Corporation MUR delivered second-quarter 2018 earnings of 36 cents per share, surpassing the Zacks Consensus Estimate of 35 cents by 2.9%. Further, the figure was significantly better than the year-ago quarter’s loss of 11 cents.

On a GAAP basis, net income per share was 26 cents compared with a loss of 10 cents in the prior-year quarter.

Revenues

In the quarter under review, Murphy Oil’s revenues totaled $618.2 million, surpassing the Zacks Consensus Estimate of $598 million by 3.4%. The top line increased 21.6% on a year-over-year basis.

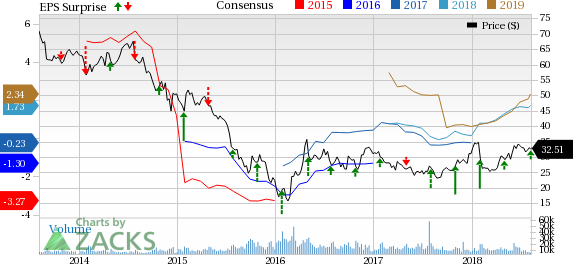

Murphy Oil Corporation Price, Consensus and EPS Surprise

Murphy Oil Corporation Price, Consensus and EPS Surprise | Murphy Oil Corporation Quote

Operational Highlights

The company produced 170,993 barrels of oil equivalent per day (boe/d) in the second quarter up 5% than year ago figure of 162,857 boe/d. The production exceeded guidance range of 166,000 to 169,000 boe/d, courtesy of improved performance in the high-margin Front Runner, Clipper, Thunder Hawk and Kodiak Fields in the Gulf of Mexico.

Murphy Oil sold 170,681 boe/d, up 6.5% from 160,203 boe/d in the year-ago quarter.

Murphy Oil’s total costs and expenses were $476.1 million, up 6.5% from $446.7 million in the year-ago quarter.

Operating income from continuing operations came in at $142.1 million, higher than $61.6 million in the prior-year quarter.

The company incurred interest charges of $44.7 million, down 1% from $45.1 million in the prior-year quarter.

Financial Condition

Murphy Oil had cash and cash equivalents of $901.3 million as of Jun 30, 2018 compared with $965 million as of Dec 31, 2017.

Long-term debt was $2,897.3 million as of Jun 30, 2018 compared with $2,906.5 million as of Dec 31, 2017.

Net cash provided by continuing operations activities at the end of first half of 2018 was $624.5 million, higher than $591.5 million at the end of the first half of 2017.

In the reported quarter, the company’s total capital expenditure was $300.7 million compared with $200.5 million in the year-ago quarter.

Guidance

Murphy Oil expects net production for third-quarter 2018 in the range of 166,500 to 168,500 boe/d. For 2018, production is estimated in the range of 168,500 to 170,500 boe/d.The company expects 2018 capital expenditure budget to be $1.18 billion.

Other Releases

Anadarko Petroleum Corporation APC reported second-quarter 2018 earnings of 60 cents per share, lagging the Zacks Consensus Estimate of 54 cents by 10.0%.

Newfield Exploration Company NFX reported second-quarter 2018 earnings of 94 cents per share, beating the Zacks Consensus Estimate of 81 cents by 16.1%.

Cabot Oil & Gas Corporation COG reported second-quarter 2018 earnings of 13 cents per share, lagging the Zacks Consensus Estimate of 19 cents by 31.58%.

Zacks Rank

Murphy Oil currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cabot Oil & Gas Corporation (COG) : Free Stock Analysis Report

Newfield Exploration Company (NFX) : Free Stock Analysis Report

Anadarko Petroleum Corporation (APC) : Free Stock Analysis Report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research