What You Must Know About The Berkeley Group Holdings plc’s (LON:BKG) Financial Health

Stocks with market capitalization between $2B and $10B, such as The Berkeley Group Holdings plc (LSE:BKG) with a size of £5.67B, do not attract as much attention from the investing community as do the small-caps and large-caps. However, generally ignored mid-caps have historically delivered better risk-adjusted returns than the two other categories of stocks. I will take you through a few basic checks to assess the financial health of companies with no debt. View our latest analysis for Berkeley Group Holdings

Is BKG’s level of debt at an acceptable level?

A substantially higher debt poses a significant threat to a company’s profitability during a downturn. For BKG, the debt-to-equity ratio is 12.46%, which means its debt level does not pose a threat to its operations right now. No matter how high the company’s debt, if it can easily cover the interest payments, it’s considered to be efficient with its use of excess leverage. A company generating earnings (EBIT) at least three times its interest payments is considered financially sound. In BKG’s case, its interest is excessively covered by its earnings as the ratio sits at 104.24x. Lenders may be less hesitant to lend out more funding as BKG’s high interest coverage is seen as responsible and safe practice.

Does BKG’s liquid assets cover its short-term commitments?

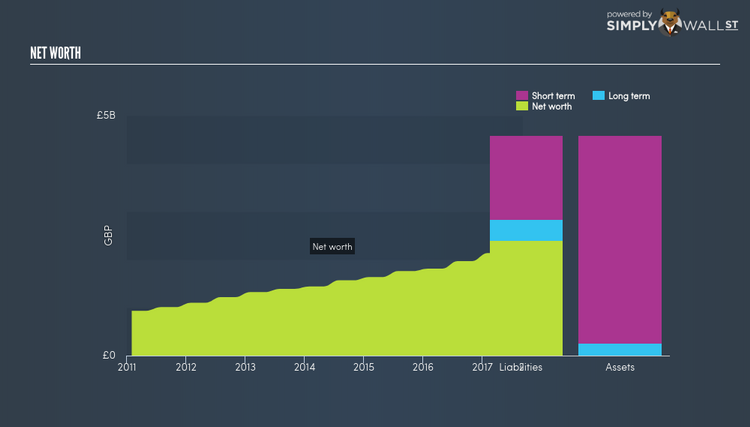

Debt to equity ratio is an important aspect of financial strength. But if the company has a substantial amount of cash on its balance sheet, that should allay some fear of a debt overhang and increase the chance of meeting upcoming liabilities. In order to measure liquidity, we must compare BKG’s current assets with its upcoming liabilities. Our analysis shows that BKG does have enough liquid assets on hand to meet its upcoming liabilities, which lowers our concerns should adverse events arise.

Next Steps:

Are you a shareholder? BKG’s relatively safe debt levels is even more impressive due to its ability to generate high cash flow, which illustrates operating efficiency. Given that BKG’s financial situation may change over time, I encourage researching market expectations for BKG’s future growth on our free analysis platform.

Are you a potential investor? While investors should analyse the serviceability of debt, it shouldn’t be viewed in isolation of other factors. Ultimately, debt is often used to fund or accelerate new projects that are expected to improve a company’s growth trajectory in the longer term. BKG’s Return on Capital Employed (ROCE) in order to see management’s track record at deploying funds in high-returning projects.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.