What You Must Know About Chanticleer Holdings Inc’s (HOTR) Financial Strength

Chanticleer Holdings Inc (NASDAQ:HOTR) is a small-cap stock with a market capitalization of USD $6.81M. While investors primarily focus on the growth potential and competitive landscape of the small-cap companies, they end up ignoring a key aspect, which could be the biggest threat to its existence: its financial health. Why is it important? A major downturn in the energy industry has resulted in over 150 companies going bankrupt and has put more than 100 on the verge of a collapse, primarily due to excessive debt. Thus, it becomes utmost important for an investor to test a company’s resilience for such contingencies. In simple terms, I believe these three small calculations tell most of the story you need to know. See our latest analysis for HOTR

Does HOTR generate enough cash through operations?

Unxpected adverse events, such as natural disasters and wars, can be a true test of a company’s capacity to meet its obligations. These adverse events bring devastation and yet does not absolve the company from its debt. Can HOTR pay off what it owes to its debtholder by using only cash from its operational activities? In the case of HOTR, operating cash flow turned out to be -0.11x its debt level over the past twelve months. This means what HOTR can generate on an annual basis, which is currently a negative value, does not cover what it actually owes its debtors in the near term. This raises a red flag, looking at HOTR’s operations at this point in time.

Does HOTR’s liquid assets cover its short-term commitments?

In addition to debtholders, a company must be able to pay its bills and salaries to keep the business running. During times of unfavourable events, HOTR could be required to liquidate some of its assets to meet these upcoming payments, as cash flow from operations is hindered. We test for HOTR’s ability to meet these needs by comparing its cash and short-term investments with current liabilities. Our analysis shows that HOTR is unable to meet all of its upcoming commitments with its cash and other short-term assets. While this is not abnormal for companies, as their cash is better invested in the business or returned to investors than lying around, it does bring about some concerns should any unfavourable circumstances arise.

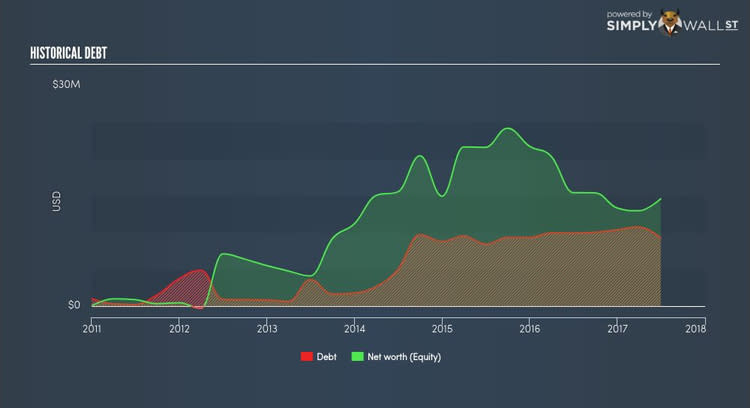

Is HOTR’s level of debt at an acceptable level?

Debt-to-equity ratio tells us how much of the asset debtors could claim if the company went out of business. For HOTR, the debt-to-equity ratio is 63.61%, which indicates that its debt can cause trouble for the company in a downturn but it is still at a manageable level.

Next Steps:

Are you a shareholder? HOTR’s cash flow coverage indicates it could improve its operating efficiency in order to meet demand for debt repayments should unforeseen events arise. In addition to this, the company may not be able to pay all of its upcoming liabilities from its current short-term assets. Given that its financial position may change. I suggest keeping on top of market expectations for HOTR’s future growth on our free analysis platform.

Are you a potential investor? HOTR’s large debt ratio on top of poor cash coverage as well as low liquidity coverage of short-term expenses may not build the strongest investment case. But, keep in mind that this is a point-in-time analysis, and today’s performance may not be representative of HOTR’s track record. As a following step, you should take a look at HOTR’s past performance analysis on our free platform to conclude on HOTR’s financial health.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.