Must-Have Stocks In Your Portfolio

Determining which stock to add to your portfolio can be challenging. You need to consider your current portfolio holdings and how you can add more value while lowering risk. Looking at stocks with great fundamentals such as strong returns and great value can be a good place to start. Below is a compilation of stocks that possess impressive aspects in two or more fundamentals, causing them to be desirable investments for every investor.

Cullen/Frost Bankers, Inc. (NYSE:CFR)

Cullen/Frost Bankers, Inc. operates as the holding company for Frost Bank that offers commercial and consumer banking services in Texas. Founded in 1868, and currently headed by CEO Phillip Green, the company now has 4,270 employees and with the company’s market capitalisation at USD $6.75B, we can put it in the mid-cap group.

CFR’s previous bottom-line expansion of 20.00% in the prior year, surpassing its industry profit growth level of 3.30%, paints an buoyant picture for the company. CFR has maintained a strong level of equity relative to its debt funding, resulting in a favorable asset-to-equity position, which is crucial for a financial firm. In addition to this, CFR’s profit levels are sufficient enough to reinvest and payout as dividends, which has also been steadily increasing over time. Interested in Cullen/Frost Bankers? Find out more here.

OceanFirst Financial Corp. (NASDAQ:OCFC)

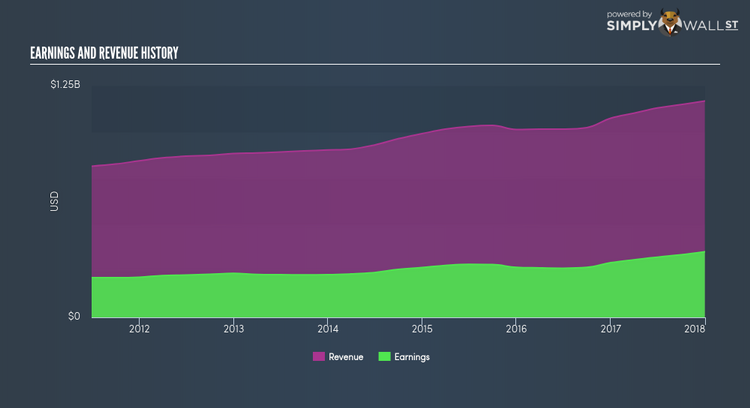

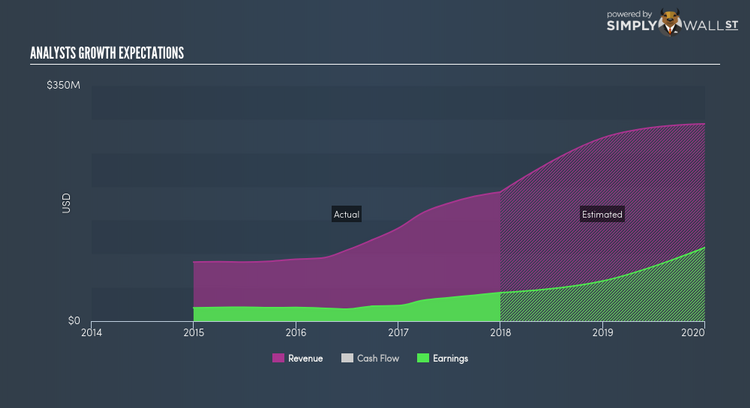

OceanFirst Financial Corp. operates as the holding company for OceanFirst Bank N.A. Established in 1902, and headed by CEO Christopher Maher, the company size now stands at 348 people and with the market cap of USD $1.25B, it falls under the small-cap stocks category.

Investors in search for stocks with room to flourish should look no further than OCFC, with its expected earnings growth of 48.17%, bolstered by an impressive double-digit top-line expansion of 52.76%. OCFC’s earnings growth in the past year of 84.28%, surpassing its industry profit growth level of 0.98%, paints an buoyant picture for the company. Additionally, OCFC has maintained a strong level of equity relative to its debt funding, resulting in a favorable asset-to-equity position, which is crucial for a financial firm. Continue research on OceanFirst Financial here.

Yintech Investment Holdings Limited (NASDAQ:YIN)

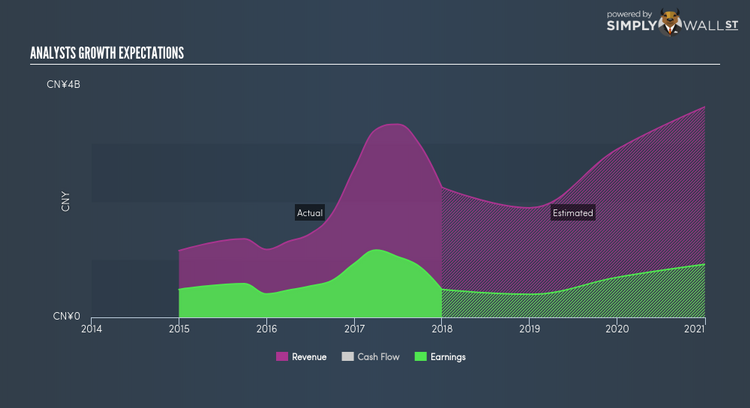

Yintech Investment Holdings Limited, together with its subsidiaries, provides trading and investment services for online spot commodity trading. Started in 2011, and currently headed by CEO Wenbin Chen, the company provides employment to 4,220 people and has a market cap of USD $644.82M, putting it in the small-cap stocks category.

Investors in search for stocks with room to flourish should look no further than YIN, with its expected earnings growth of 25.72% exceeding the market average earnings growth rate of 4.47%. YIN has sufficient cash and investments to meet its upcoming liabilities, and the business has no debt on its books, which indicates its strong financial position. In addition, YIN’s shares are now trading at a price below its true value based on its PE ratio of 8.42x, compared to the industry and wider stock market ratio, making it a relatively cheap stock compared to its peers. More detail on Yintech Investment Holdings here.

For more fundamentally-robust companies with industry-beating characteristics to enhance your portfolio, explore this interactive list of big green snowflake stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.