Mylan Bears Could Double Their Money By Christmas

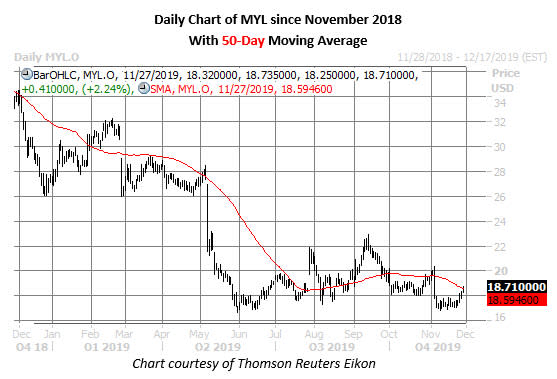

Mylan NV (NASDAQ:MYL) hit a five-month low of $16.79 on Nov. 8, but has since added 11.1% -- up 2.2% today at $18.71, thanks to an upgrade to "hold" from "sell" at CFRA. This rebound could be short-lived, though, with MYL now trading near a trendline that's had bearish implications in the past.

Specifically, MYL is running into its 50-day moving average, which has acted as resistance over the past three years, according to Schaeffer's Senior Quantitative Analyst Rocky White. In the six prior times this signal has sounded, MYL was down 10.1%, on average, one month out.

What's more, Mylan's Schaeffer's Volatility Index (SVI) is currently perched near its two-year average of 39.5%, last seen at 36%. Not only does the current ratio rank in the 14th annual percentile, suggesting short-term options premiums are relatively cheap at the moment, but White's modeling shows that an at-the-money MYL put option could potentially return 134% on another expected retreat from resistance at the 50-day trendline. In other words, prospective put buyers could more than double their money on a 10.1% drop in the shares.

Short sellers have been targeting the stock, too, with short interest up 4.9% in the most recent reporting period. The 24.17 million shares currently controlled by shorts accounts for not even 5% of the security's available float. This suggests the bearish bandwagon is far from full, and continued short covering could create stiffer headwinds for MYL shares.

Plus, there's plenty of room for analysts to downwardly revise their outlooks on a stock that's slumped 31.8% in 2019. Currently seven of 13 brokerages maintain a "buy" or better rating, while the average 12-month price target of $25.81 is a 38% premium to current trading levels. Bear notes could amplify selling pressure on the shares.