Nasdaq Composite in Positive for 5 Straight Days: 5 Top Picks

The tech-heavy Nasdaq Composite index is on the rise again after closing in positive territory for five successive trading days. The tech rally can be attributed to strong showing by several tech behemoths. This also highlights the fading of investors’ apprehensions regarding a full-fledged global trade war at least for the time being, and their confidence on strong U.S. economy.

Moreover, U.S. corporates have so far reported robust results for second-quarter 2018, maintaining the terrific earnings momentum which has commenced since the first-quarter 2018. Consequently, it will be a prudent move to invest in tech stocks which carry a favorable Zacks Rank and are part of the Nasdaq Composite.

Large-Cap Tech Stocks Lead Market rally

On Aug 6, Nasdaq Composite increased 0.6% to end at 7,859.68, posting gains for five consecutive trading days. This has happened for the first time since May. Year to date, the tech-laden index gained nearly 13.9%.

Yesterday’s tech rally was primarily driven by a surge of 4.5% in shares of Facebook Inc. FB reflecting its biggest one-day rise since April. The share price surged following a report by The Wall Street Journal stating that the company has asked large U.S. banks to incorporate users' financial information into Messenger.

Meanwhile, tech behemoth Apple Inc. AAPL, which became the first publicly traded U.S. company to cross a market cap of $1 trillion on Aug 2, extended its gain further on last two trading days by 0.3% and 0.5%, respectively.

So far in 2018, the technology sector stocks are the best performers. Technology Select Sector SPDR (XLK) is up 14.3% year to date. Market anticipates this sector to be least affected by the Trump administration’s intended second round of tariffs worth $200 billion on Chinese imports, consequently aiding the rally.

Escalating Earnings Expectations

Investors have pinned high hopes on second-quarter 2018 earnings results. U.S. corporates have so far posted better-than-expected numbers. Already 410 S&P 500 members have reported their quarterly results. Total earnings for these companies are up 24.9% from the same period last year on 10.1% higher revenues.

Notably, in the second-quarter, total earnings of S&P 500 companies are expected to be up 23.9% from the same period last year on 9.3% higher revenues. (Read More: Should We Worry About the Downtrend in Earnings Estimates?)

Our Top Picks

Solid macro-economic fundamentals, government’s tax reform and deregulation proposals along with sustained strong earnings performance are major tailwinds for the U.S. economy. Such factors are unlikely to disappear in the near term. At this stage, investment in Nasdaq stocks with strong earnings momentum will be lucrative. However, picking winning stocks can be a difficult task.

This is where our VGM Score comes in handy. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three scores. Such a score allows you to eliminate the negative aspects of stocks and select winners. However, it is important to keep in mind that each Style Score will carry a different weight while arriving at a VGM Score.

We have narrowed down our search to five stocks, each of which has a Zacks Rank #1 (Strong Buy) and a VGM Score A or B. You can see the complete list of today’s Zacks #1 Rank stocks here.

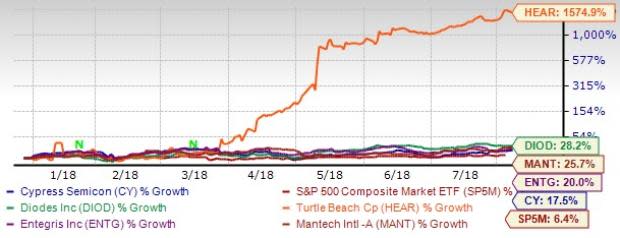

The chart below shows price performance of our five picks year to date.

Turtle Beach Corp. HEAR designs audio products for consumer, commercial and healthcare markets. It markets premium headsets for use with personal computers, mobile devices and video game consoles. Turtle Beach has a VGM Score of A. The company has expected earnings growth of 625% for current year. The Zacks Consensus Estimate for the current year has improved by 29.9% over the last 30 days.

Diodes Inc. DIOD is a leading manufacturer and supplier of high-quality discrete and analog semiconductor products, primarily to the communications, computing, industrial, consumer electronics and automotive markets. Diodes has a VGM Score of A. The company has expected earnings growth of 58.4% for current year. The Zacks Consensus Estimate for the current year has improved by 5.9% over the last 30 days.

Cypress Semiconductor Corp. CY is a leader in advanced embedded system solutions for automotive, industrial, home automation and appliances, consumer electronics and medical products. Cypress Semiconductor has a VGM Score of A. The company has expected earnings growth of 50.6% for current year. The Zacks Consensus Estimate for the current year has improved by 7.2% over the last 30 days.

Entegris Inc. ENTG is a leading provider of materials management solutions to the microelectronics industry particularly, the semiconductor manufacturing and disk manufacturing markets. Entegris has a VGM Score of B. The company has expected earnings growth of 35.4% for current year. The Zacks Consensus Estimate for the current year has improved by 7.1% over the last 30 days.

ManTech International Corp. MANT is a leading provider of innovative technologies and solutions for mission-critical national security programs for the Intelligence Community. ManTech International has a VGM Score of B. The company has expected earnings growth of 27.8% for current year. The Zacks Consensus Estimate for the current year has improved by 1% over the last 30 days.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Entegris, Inc. (ENTG) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

Cypress Semiconductor Corporation (CY) : Free Stock Analysis Report

Turtle Beach Corporation (HEAR) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

ManTech International Corporation (MANT) : Free Stock Analysis Report

Diodes Incorporated (DIOD) : Free Stock Analysis Report

To read this article on Zacks.com click here.