Nasdaq Exits Coronavirus-Led Bear Market: 5 Tech Stocks to Buy

U.S. equity markets have been surging for the last three weeks, with the Nasdaq Composite index exiting the bear-market territory, as investors hope that the economy will recover from the coronavirus crisis. This optimism is backed by the combined efforts of the U.S. government and the Federal Reserve to pull the economy out of choppy waters.

In the last three weeks, both the U.S. government and the central bank announced massive stimulus packages to mitigate the economic damage from the coronavirus pandemic. The first major relief package of $2 trillion was announced on Mar 27 to aid individuals and small businesses, which have been hit hardest by the pandemic. The U.S. economy received another boost from the Fed on Apr 9, when it announced a $2.3-trillion infrastructure package.

As a result, the Nasdaq Composite index has rallied 24.1% since Mar 23, and the year-to-date (YTD) decline has come down to 5.1% from 23.3% as of Mar 20.

We believe the maximum weightage of Tech stocks (approximately 50%) in its components has helped the Nasdaq Composite make a quick recovery compared with the Dow Jones and S&P 500 indices. The Dow Jones and the S&P 500 have been down 16.1% and 11.9%, respectively, in the year so far.

We have observed that though the coronavirus outbreak has affected every sector, the U.S. tech sector has been more resilient compared with others. The Technology Select Sector SPDR Fund XLK is down 2.9%, year to date, while the Energy Select Sector SPDR Fund, the Financial Select Sector SPDR Fund and the Industrial Select Sector SPDR Fund have lost 44.3%, 26.5%, and 23.3%.

Among the Nasdaq’s 100 components, only 34 stocks have registered positive YTD returns, of which 17 are from the Computer and Technology sector.

Why is the Tech Sector Least Affected?

The coronavirus outbreak has, surprisingly, opened up newer avenues of growth for tech companies. The pandemic-led global lockdown is fueling demand for PCs, notebooks and peripheral accessories, as an increasing number of workers and students are now working and learning from home.

The work-and-learn-from home necessity is also stoking demand for cloud storage. Furthermore, the lockdown has bolstered the usage of online and e-commerce services globally. Therefore, data-center operators are enhancing their capacities to accommodate the demand spike for cloud services. (Read More: 6 Remote-Working Software Stocks to Ride on Virus-Led Lockdowns)

Furthermore, the long-term growth prospects of tech companies look promising owing to continuous digital transformations. The rapid adoption of cloud computing, along with the ongoing integration of AI and machine learning, has been a major growth driver.

The accelerated deployment of 5G technology — the next-generation wireless revolution — is likely to fuel further growth. Moreover, blockchain, IoT, autonomous vehicles, AR/VR and wearables offer significant growth opportunities.

Considering the healthy growth prospects of tech companies, it makes sense to invest in this space for long-term gains. Amid this economic and financial instability, it is a prudent idea to pick solid growth companies as these are financially stable, reaping profits in established markets. These stocks, with their healthy fundamentals, help investors hedge their investments from any economic downturns.

Here, we have zeroed in on five Nasdaq-traded tech stocks that are well poised to benefit from this space’s solid growth prospects.

These stocks also have favorable combinations of a Growth Score of A or B, and a Zacks Rank #1 (Strong Buy) or #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per the Zacks’ proprietary methodology, stocks with such favorable combinations offer solid investment opportunities.

Our Picks

Dropbox DBX, which currently sports a Zacks Rank #1, is poised to benefit from the shift in demand trend owing to the coronavirus outbreak. The company, which has a Growth Score of A, offers a platform that enables users to store and share files, photos, videos, songs and spreadsheets.

Due to the global lockdown, workers now need to work from home which is propelling demand for cloud storage. Additionally, the company is benefiting from the evolving workspace demands for seamless enterprise communication tools. Further, integration with leading applications like Zoom Video, Slack and Atlassian will likely expand the Dropbox paying-user base over the long run.

Dropbox, Inc. Price and Consensus

Dropbox, Inc. price-consensus-chart | Dropbox, Inc. Quote

The 21Vianet Group VNET stock has been gathering strength from the shift in demand trends, thanks to the coronavirus outbreak. This Zacks #2 Ranked company operates as a carrier-neutral internet data-center services provider in China. The stock has a Growth Score of A.

Due to the lockdown situation worldwide, workers and students now need to work and learn from home. The work-and-learn-from-home necessity is stoking demand for cloud storage. Furthermore, the lockdown has bolstered the usage of online and e-commerce services globally, thereby driving demand for data-center services.

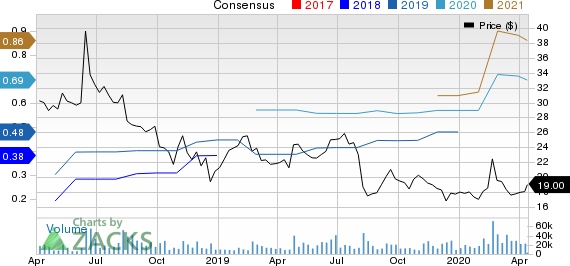

21Vianet Group, Inc. Price and Consensus

21Vianet Group, Inc. price-consensus-chart | 21Vianet Group, Inc. Quote

Avid Technology AVID is anticipated to benefit from increasing recurring revenues on growth in subscriptions and the long-term agreements already signed. An expanding paid subscriber base and rising adoption of creative tools, aided by the solid demand for the media, graphics and cloud solutions, are other tailwinds. The company currently flaunts a Zacks Rank #1 and has a Growth Score of A.

Avid Technology, Inc. Price and Consensus

Avid Technology, Inc. price-consensus-chart | Avid Technology, Inc. Quote

Cogent Communications Holdings CCOI is poised to gain from the rising necessity for work-and-learn-from-home settings amid coronavirus crisis. This Zacks Rank #2 company offers low-cost high-speed Internet access, private network services and colocation center services. The ongoing digital transformation and rapid adoption of cloud services are key catalysts for long-term growth. The stock has a Growth Score of A.

Cogent Communications Holdings, Inc. Price and Consensus

Cogent Communications Holdings, Inc. price-consensus-chart | Cogent Communications Holdings, Inc. Quote

CrowdStrike Holdings CRWD, which provides cloud-delivered endpoint protection, is well placed to benefit from the rising work-and-learn-from-home trend. As more and more organizations are now working remotely amid this crisis, their cybersecurity needs are likely to spike. Notably, the increasing number of work-from-home employees is aggravating security lapses, triggering risks of hacking and phishing scams using coronavirus as the subject content.

Apart from this, the usage of own devices and equipment that are not properly configured or can be infected with malware during teleworking further raises possible security breaches for enterprises. Currently, CrowdStrike carries a Zacks Rank of 2 and has a Growth Score of A.

CrowdStrike Holdings Inc. Price and Consensus

CrowdStrike Holdings Inc. price-consensus-chart | CrowdStrike Holdings Inc. Quote

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avid Technology, Inc. (AVID) : Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

21Vianet Group, Inc. (VNET) : Free Stock Analysis Report

Cogent Communications Holdings, Inc. (CCOI) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

CrowdStrike Holdings Inc. (CRWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research