NasdaqGS Favorite Cyclical Dividend Stocks

A consumer cyclical company performance is driven by the business cycle. Companies such as Big 5 Sporting Goods and Escalade offer goods and services that are luxuries, instead of absolute necessities, such as entertainment and gambling. In periods of growth, consumers benefit from higher discretionary income which drives these companies’ profitability. This tends to lead to higher cash flows and hefty dividend income for an investors’ portfolio. If you’re a long term investor, these high-dividend consumer cyclical stocks can boost your monthly portfolio income.

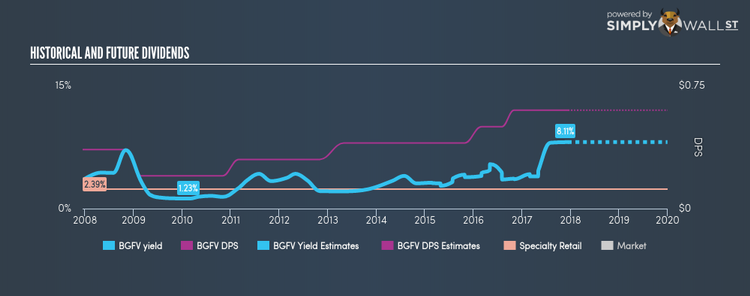

Big 5 Sporting Goods Corporation (NASDAQ:BGFV)

BGFV has a sumptuous dividend yield of 8.11% and is currently distributing 59.56% of profits to shareholders , with the expected payout in three years being 62.12%. While there’s been some fluctuation in the yield over the last 10 years, the dividends per share have increased in this time. The company recorded earnings growth of 61.76% in the past year, comparing favorably with the us specialty retail industry average of 8.14%.

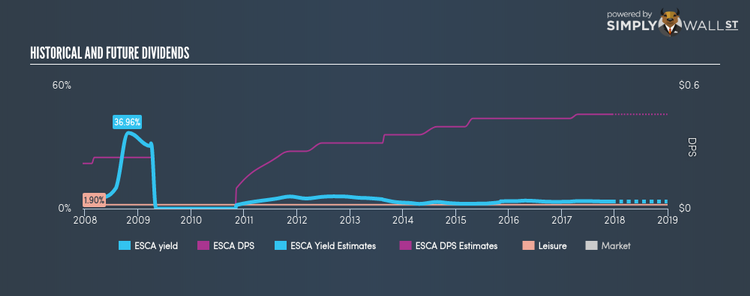

Escalade, Incorporated (NASDAQ:ESCA)

ESCA has a wholesome dividend yield of 3.45% and has a payout ratio of 64.80% . Dividends per share have increased during the past 10 years, but there have been a couple hiccups. However, they have historically always picked up again.

Weyco Group, Inc. (NASDAQ:WEYS)

WEYS has a solid dividend yield of 3.09% and is paying out 53.52% of profits as dividends . WEYS’s dividends have seen an increase over the past 10 years, with payments increasing from $0.44 to $0.88 in that time. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. Weyco Group’s earnings per share growth of 8.45% over the past 12 months outpaced the us distributors industry’s average growth rate of 4.66%.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.