NasdaqGS Healthcare Industry: A Deep Dive Into Endologix Inc (ELGX)

Endologix Inc (NASDAQ:ELGX), a USD$493.93M small-cap, operates in the healthcare industry, which continues to be affected by the sustained economic uncertainty and structural trends, such as an aging population, impacting the sector globally. Healthcare analysts are forecasting for the entire industry, a positive double-digit growth of 21.23% in the upcoming year , and a whopping growth of 68.64% over the next couple of years. This rate is larger than the growth rate of the US stock market as a whole. Today, I’ll take you through the sector growth expectations, as well as evaluate whether ELGX is lagging or leading in the industry. See our latest analysis for ELGX

What’s the catalyst for ELGX’s sector growth?

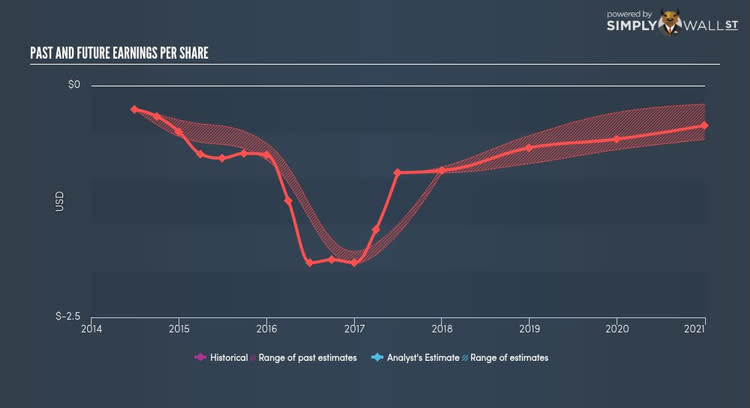

Integration with technology for more personalized and data-driven equipment, underpinning healthcare ‘internet of things’ has been a structural shift for the healthcare equipment providers. In the previous year, the industry saw growth in the teens, beating the US market growth of 10.30%. ELGX leads the pack with its impressive earnings growth of 50.87% over the past year. However, analysts are not expecting this industry-beating trend to continue, with future growth expected to be 15.53% compared to the wider healthcare equipment sector growth hovering in the twenties next year.

Is ELGX and the sector relatively cheap?

Healthcare companies are typically trading at a PE of 42x, higher than the rest of the US stock market PE of 22x. This means the industry, on average, is relatively overvalued compared to the wider market. However, the industry returned a similar 11.31% on equities compared to the market’s 10.06%. Since ELGX’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge ELGX’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

Are you a shareholder? ELGX is a healthcare equipment industry laggard in terms of its future growth outlook. If your initial investment thesis is around the growth prospects of ELGX, there are other healthcare equipment companies that are expected to deliver higher growth in the future, and perhaps trading at a discount to the industry average. Consider how ELGX fits into your wider portfolio and the opportunity cost of holding onto the stock.

Are you a potential investor? If ELGX has been on your watchlist for a while, now may be a good time to dig deeper into the stock. Although its growth is expected to be lower than its healthcare equipment peers in the near term, the market may be pessimistic on the stock, leading to a potential undervaluation. Before you make a decision on the stock, I suggest you look at ELGX’s future cash flows in order to assess whether the stock is trading at a reasonable price.

For a deeper dive into Endologix’s stock, take a look at the company’s latest free analysis report to find out more on its financial health and other fundamentals. Interested in other healthcare stocks instead? Use our free playform to see my list of over 1000 other healthcare companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.