National Fuel Gas' (NFG) Board Approves 2.2% Dividend Hike

National Fuel Gas Company NFG announced that the board of directors has approved a 2.2% increase in the quarterly dividend rate. The revised quarterly dividend will be 45.5 cents, payable on Jul 15, 2021 to shareholders of record at the close of business on Jun 30.

The company’s new annualized dividend rate is $1.82 per share, resulting in a dividend yield of 3.43%, which is better than the industry average of 2.97%. This marks the 51st straight year of increase in the annual dividend rate by the board of directors, reflecting its strong performance.

Utilities’ History of Dividend Payment

The companies that are involved in utility services generally have stable operations and earnings. Consistent performance and the ability to generate cash flows allow utilities to reward shareholders with regular dividend. National Fuel Gas has been paying dividend for 119 consecutive years.

It is not the only company with a track record of more than 100 years of consistent dividend payment. Utilities like Consolidated Edison, Inc. ED and Edison International EIX have also been rewarding shareholders with dividend payments for more than 100 years without fail.

Can the Company Sustain This Dividend Legacy?

It is very difficult to predict whether a company can continue paying dividend in the future as well. The ability to pay dividend depends on business conditions, and willingness of the board of directors to share profits and not save it for future capital projects.

The company’s systematic capital spending to strength natural gas and oil operations is positively impacting total production. National Fuel Gas Company has invested $2 billion since 2010 in midstream operations to expand and modernize its pipeline infrastructure for gaining access to Appalachian production. Moreover, National Fuel Gas’ acquisition of Royal Dutch Shell’s RDS.A upstream and midstream assets in Pennsylvania for $500 million was accretive to its earnings.

National Fuel Gas is expanding operations through organic means and strategic acquisitions, which will enable it to generate stable cash flow as economic conditions continue to improve and assist management to carry on shareholder-friendly initiatives.

Price Movement

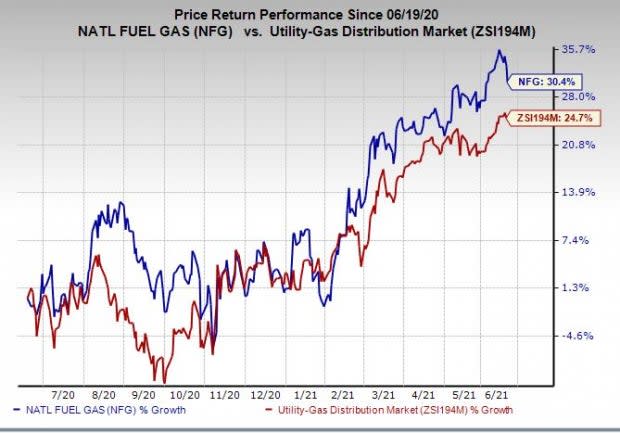

In the past 12 months, National Fuel Gas’ shares have gained 30.4% compared with the industry’s growth of 24.7%.

Image Source: Zacks Investment Research

Zacks Rank

National Fuel Gas currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Dutch Shell PLC (RDS.A) : Free Stock Analysis Report

Edison International (EIX) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

National Fuel Gas Company (NFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research