National Oilwell (NOV) Q2 Earnings & Sales Beat Estimates

National Oilwell Varco, Inc. NOV reported second-quarter 2018 adjusted earnings of 6 cents per share, surpassing the Zacks Consensus Estimate of 3 cents. Stronger-than-expected contribution from all segments led to this stellar show.

Operating profit from the Rig Technologies segment totaled $62 million, way above the Zacks Consensus Estimate of $37.37 million. Further, operating profit from the Completion & Production Solutions segment came in at $40 million, surpassing the estimate of $28.60 million. Operating profit of $38 million at Wellbore Technologies also topped the Zacks Consensus Estimate of $35 million.

The bottom line also witnessed a solid rebound from the year-ago quarter’s loss of 20 cents on the back of crude pricing strength, increased demand and higher year-over-year revenues from all its segments.

Total revenues of $2,106 million outpaced the Zacks Consensus Estimate of $1,991 million. Revenues also rose 19.7% and 17.3% year over year and sequentially, respectively.

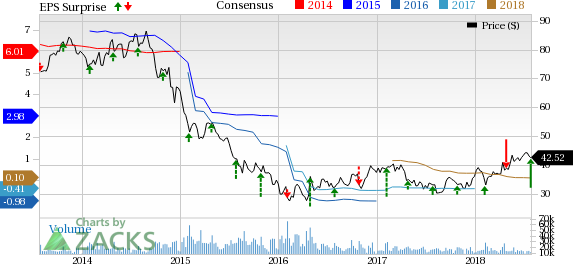

National Oilwell Varco, Inc. Price, Consensus and EPS Surprise

National Oilwell Varco, Inc. Price, Consensus and EPS Surprise | National Oilwell Varco, Inc. Quote

Segmental Performance

Rig Technologies: Revenues came in at $651 million compared with $546 million in the year-ago quarter, reflecting an increase of 19.2%. Revenues at the segment also rose 34.8% sequentially. Fast progress in new offshore rig construction led to the better performance.

The unit’s adjusted EBITDA was $84 million, 82.6% higher than $46 million recorded in the year-ago quarter. The segment’s EBITDA also surged 86.6% sequentially, driven by increase in the orders.

Wellbore Technologies: The segment’s revenues rose 29.2% year over year to $793 million. Strong demand from greater market adoption of the unit’s superior technology services drove revenues. Revenues from this segment also climbed around 12% sequentially on the back of increased activities in the Eastern Hemisphere.

Importantly, the unit improved from last year’s adjusted EBITDA of $66 million to $133 million, aided by higher volumes and pricing gains. In addition, the figure came in higher than the prior-quarter’s $103 million.

Completion & Production Solutions: Revenues at the segment were $738 million, up 13.2% from $652 million in the year-ago quarter. The top line also improved from the prior quarter’s figure of $670 million. Elevated demand for capital equipment in North America, along with increase in deliveries, drove the upside.

The unit recorded adjusted EBITDA of $94 million, marginally down from the year-ago figure of $98 million. However, the reported figure witnessed an increase of 28.7% sequentially.

Backlog

Capital equipment order backlog for Rig Technologies was $3.51 billion as of Jun 30, 2018, including $2.03 billion million worth of new orders. Notably, 88.7% of the new orders were associated with National Oilwell’s JV agreement with Saudi Aramco.

Moreover, the Completion & Production Solutions segment reported a backlog of $995 million in capital equipment order at the end of the second quarter. The figure included $398 million of new orders.

Balance Sheet

As of Jun 30, 2018, the company had cash and cash equivalents of $1,137 million and long-term debt of $2,707 million. The debt-to-capitalization ratio was around 16.2%.

Zacks Rank and Key Picks

Currently, National Oilwell carries a Zacks Rank #3 (Hold).

Some better-ranked players in the energy space are ConocoPhillips COP, China Petroleum and Chemical Corporation SNP, also known as Sinopec, and CVR Refining, LP CVRR, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ConocoPhillips, based in Houston, TX, is a major global exploration and production (E&P) company. It pulled off an impressive average positive earnings surprise of 226.9% over the last four quarters.

Sinopec is one of the largest petroleum and petrochemical companies in Asia. The company delivered an outstanding average positive earnings surprise of 492.8% over the trailing four quarters.

Sugar Land, TX-based CVR Refining is an independent downstream energy partnership with refining and associated logistics properties in the Midcontinent United States. The company delivered an average positive earnings surprise of 7.05% in the preceding four quarters.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CVR Refining, LP (CVRR) : Free Stock Analysis Report

China Petroleum & Chemical Corporation (SNP) : Free Stock Analysis Report

National Oilwell Varco, Inc. (NOV) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

To read this article on Zacks.com click here.