National Oilwell Varco Hemorrhages Red in Q2

While oil prices have improved in recent years, that has yet to drive a meaningful rebound in the oilfield service and equipment market. That's because crude remains quite volatile. Those conditions are forcing oil companies to keep a tight lid on spending, which is holding down industry activity levels. With market conditions not bouncing back as much as expected, National Oilwell Varco (NYSE: NOV) had to record a substantial writedown during the second quarter, which muddied its results.

Drilling down into the results

Metric | Q2 19 | Q2 18 | Q1 19 |

|---|---|---|---|

Revenue | $2.13 billion | $2.11 billion | $1.94 billion |

Net income | ($5.4 billion) | $24 million | ($77 million) |

Earnings per share | ($14.11) | $0.06 | ($0.20) |

Data source: National Oilwell Varco.

With oilfield service market conditions still sluggish, National Oilwell Varco reviewed the carrying value of its assets during the quarter. Based on that evaluation, the company recorded a $5.37 billion charge. In addition to that, the company also recognized $399 million of restructuring charges during the period. These items caused the company to report a substantial loss for the second quarter.

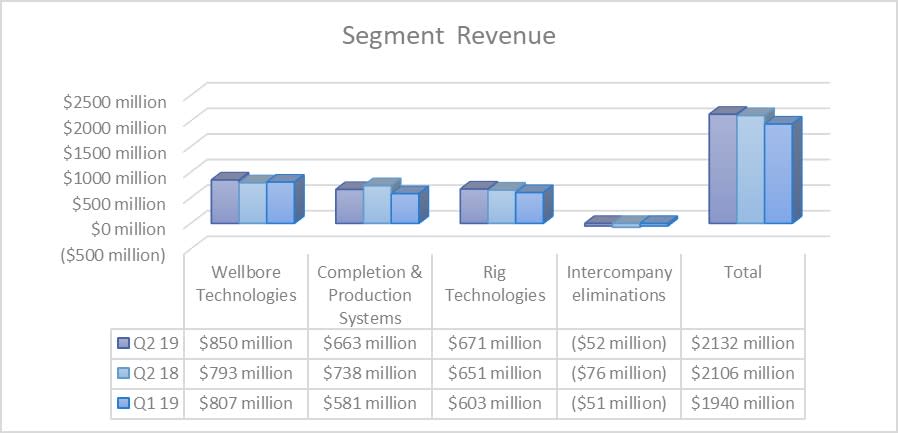

On a more positive note, though, National Oilwell Varco's revenue grew both year over year (up 1.2%) and sequentially (up 9.9%). The company benefited from nearly across-the-board improvement in its three business units:

Data source: National Oilwell Varco.

National Oilwell Varco's wellbore technologies segment delivered decent second-quarter results as revenue rose 5% from the first quarter and 7% from last year's second quarter. The main driver was sales to customers outside of North America, which jumped 14% from the first quarter, due in part to the very early stages of the long-awaited recovery in the offshore drilling market. That helped offset weakness in the shale-driven North American market, where revenue slipped 2% sequentially. However, the wellbore technologies business unit recorded an operating loss of $3.3 billion, which included taking $3.35 billion of one-time charges. On the other hand, the segment's underlying profitability, as measured by adjusted EBITDA, rose 15% from the first quarter to $134 million. Driving the improvement were higher volumes and its initiatives to reduce costs.

The company's completion and production solutions segment, meanwhile, delivered a somewhat mixed quarter. While sales increased 14% sequentially, they declined 10% year over year. This business unit also benefited from improving international and offshore market conditions. However, it did report a net loss of $1.93 billion, which was entirely due to recording $1.94 billion in one-time items. Adjusted EBITDA, meanwhile, surged 86% sequentially to $52 million. This business unit booked $548 million of new orders during the quarter, which was its highest in five years.

The rig technologies segment delivered healthy results as revenue rose 11% from the first quarter and 3% year over year. Driving the increase were higher contributions from offshore drilling projects. This segment also recorded a net loss ($422 million) due entirely to one-time items ($474 million). Adjusted EBITDA, meanwhile, surged 32% from the first quarter to $74 million. National Oilwell Varco booked $310 million of new orders, which was 14% higher than the first quarter.

Image source: Getty Images.

What management had to say

CEO Clay Williams commented on the quarter by saying:

NOV continues to face challenging cross-currents as it navigates a generational oilfield downturn. International and offshore markets are exhibiting growth, while North America land markets are declining as customers slash spending. Nevertheless, consolidated results improved sequentially in each of our three business segments, as we pivot to higher-growth areas. We were pleased to see demand for NOV's technology and equipment from international and offshore customers drive our third consecutive quarter of rising bookings for capital equipment.

As Williams points out, the company continued battling headwinds from the choppy recovery in the oil market. While international and offshore markets are finally starting to get better, those in North America are weakening again. That's because oil prices have been very volatile over the past several months. This choppiness is forcing drillers to keep a tight lid on spending to ensure they're generating enough cash flow to fund their operations.

Williams further commented on the current market conditions by stating:

The increased emphasis on capital discipline from our customer base is driving them to do more with less, and it has become clear in the second quarter that this approach is not going away anytime soon. Recognition of this challenging market dynamic, as well as lower equity values and diminished availability of capital for the energy sector led to the Company's significant impairment charge this quarter.

That charge masked the fact that the company's operating results did improve during the quarter.

Another lost year for NOV

The oil market's sluggish recovery continues to weigh on product and equipment sales, which is keeping the pressure on National Oilwell Varco's results. While conditions are getting better, they haven't improved as much as expected this year. That's unlikely to change given the continued volatility in oil prices, which is causing drillers to keep a tight lid on spending.

More From The Motley Fool

Matthew DiLallo owns shares of National Oilwell Varco. The Motley Fool owns shares of National Oilwell Varco. The Motley Fool has a disclosure policy.