Natural Grocers by Vitamin Cottage's (NYSE:NGVC) Shareholders Are Down 34% On Their Shares

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. Investors in Natural Grocers by Vitamin Cottage, Inc. (NYSE:NGVC) have tasted that bitter downside in the last year, as the share price dropped 34%. That's disappointing when you consider the market returned 39%. Even if you look out three years, the returns are still disappointing, with the share price down31% in that time. The share price has dropped 37% in three months.

Check out our latest analysis for Natural Grocers by Vitamin Cottage

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate twelve months during which the Natural Grocers by Vitamin Cottage share price fell, it actually saw its earnings per share (EPS) improve by 12%. It's quite possible that growth expectations may have been unreasonable in the past.

The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

Natural Grocers by Vitamin Cottage managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

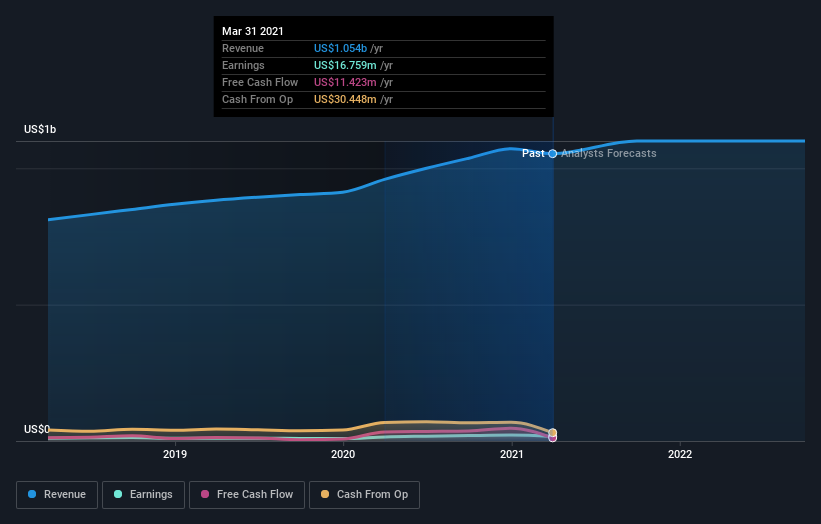

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Natural Grocers by Vitamin Cottage has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Natural Grocers by Vitamin Cottage stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Natural Grocers by Vitamin Cottage the TSR over the last year was -23%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 39% in the last year, Natural Grocers by Vitamin Cottage shareholders lost 23% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.4% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Natural Grocers by Vitamin Cottage is showing 2 warning signs in our investment analysis , you should know about...

But note: Natural Grocers by Vitamin Cottage may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.