Nektar Therapeutics Options Pop as Stock Soars

The shares of Nektar Therapeutics (NASDAQ:NKTR) are pacing for their biggest one-day jump in almost two years after the firm amended its collaboration agreement with Bristol-Myers Squibb (BMY). The two will expand an ongoing trial combining NKTR's bempegaldesleukin cancer therapy with BMY's cancer drug Opdivo, the latter of which has already been approved by the U.S. Food and Drug Administration (FDA). Nektar also announced an early stage trial to test the dosing alongside Pfizer's (PFE) Inlyta in patients with kidney cancer.

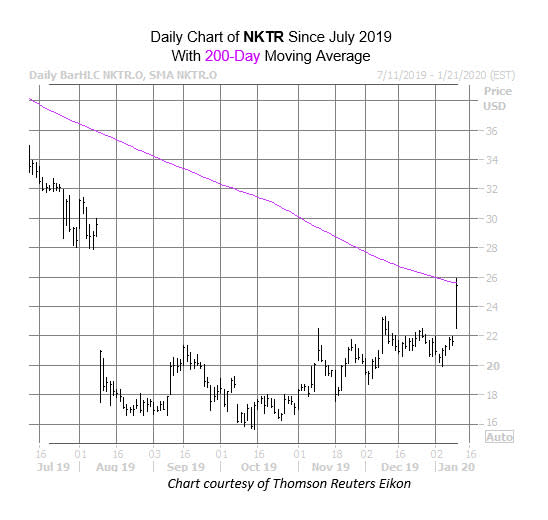

NKTR has surged 16.7% to trade at $25.19 in response, touching a five-month high of $2625 earlier today. The equity seemed to be on on its way to closing its early August bear gap, before sputtering out at the 200-day moving average -- a trendline the security hasn't closed north of since June 2018. The stock is still down roughly 40% year-over-year.

Traders are swarming the stock's normally quiet options pits. So far 12,000 calls and 1,600 puts have crossed the tape -- 15 times the intraday average and volume pacing in the 100th percentile of its annual range. The February 25 call is the most popular, with some sell-to-open activity possibly detected here, as well as the weekly 1/24 26-strike call.

This tendency towards bullish bets isn't new. In fact, at the the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), 6.88 calls have been bought to open for every put over the last 10 weeks -- a ratio that sits higher than 96% of all other readings from the past year.

Echoing this is the equity's Schaeffer's put/call open interest ratio (SOIR) of 0.29, which sits in the low 6th percentile of its annual range. This means short-term speculators are more call-heavy than usual.