Should Your Next Investment In The Energy Industry Be In Nordic American Offshore Ltd (NYSE:NAO)?

Nordic American Offshore Ltd (NYSE:NAO), a USD$73.76M small-cap, is an oil and gas company operating in an industry which has endured an extended oil price slump since mid-2014. However, energy-sector analysts are forecasting for the entire industry, an extremely elevated growth of 42.38% in the upcoming year , and an overall negative growth rate in the next couple of years. Unsuprisingly, this is below the growth rate of the US stock market as a whole. An interesting question to explore is whether we can we benefit from entering into the oil and gas sector right now. In this article, I’ll take you through the energy sector growth expectations, as well as evaluate whether Nordic American Offshore is lagging or leading its competitors in the industry. View our latest analysis for Nordic American Offshore

What’s the catalyst for Nordic American Offshore’s sector growth?

Much of the oil and gas industry has survived an especially tough few years with weak demand and low prices. Global oil and gas companies cut capital expenditures by about 40% during 2014 and 2016, and as part of this cost cutting initiative, some 400,000 workers were let go, with major projects cancelled or deferred. Only now has the sector begun to emerge from its turmoil, and in the previous year, the industry saw growth of 0.36%, though still underperforming the wider US stock market. Nordic American Offshore leads the pack with its impressive earnings growth of 44.68% over the past year. However, analysts are not expecting this industry-beating trend to continue, with future growth expected to be 35.41% compared to the wider energy sector growth hovering in the forties next year.

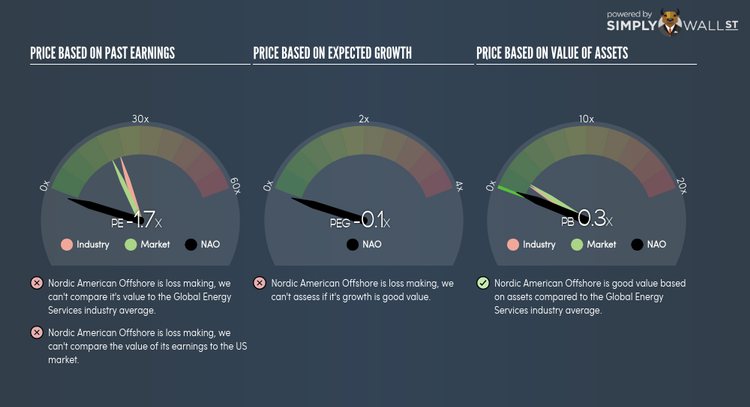

Is Nordic American Offshore and the sector relatively cheap?

The energy sector’s PE is currently hovering around 23x, relatively similar to the rest of the US stock market PE of 19x. This illustrates a fairly valued sector relative to the rest of the market, indicating low mispricing opportunities. However, the industry returned a lower 6.21% compared to the market’s 10.46%, illustrative of the recent sector upheaval. Since Nordic American Offshore’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge Nordic American Offshore’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

Are you a shareholder? Nordic American Offshore is an oil and gas industry laggard in terms of its future growth outlook. If your initial investment thesis is around the growth prospects of Nordic American Offshore, there are other oil and gas companies that are expected to deliver higher growth in the future, and perhaps trading at a discount to the industry average. Consider how Nordic American Offshore fits into your wider portfolio and the opportunity cost of holding onto the stock.

Are you a potential investor? If Nordic American Offshore has been on your watchlist for a while, now may be a good time to dig deeper into the stock. Although its growth is expected to be lower than its oil and gas peers in the near term, the market may be pessimistic on the stock, leading to a potential undervaluation. Before you make a decision on the stock, I suggest you look at Nordic American Offshore’s future cash flows in order to assess whether the stock is trading at a reasonable price.

For a deeper dive into Nordic American Offshore’s stock, take a look at the company’s latest free analysis report to find out more on its financial health and other fundamentals. Interested in other energy stocks instead? Use our free playform to see my list of over 300 other oil and gas companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.