NextEra Energy (NEE) Beats Q3 Earnings & Revenue Estimates

NextEra Energy, Inc. NEE reported third-quarter 2019 adjusted earnings of $2.39 per share, beating the Zacks Consensus Estimate of $2.27 by 5.3%. Moreover, the reported earnings were up 10.1% on a year-over-year basis.

The earnings growth was attributed to solid contribution from all its business segments.

On a GAAP basis, NextEra Energy recorded earnings of $1.81 per share, down 13.8% from $2.1 reported in the year-ago quarter.

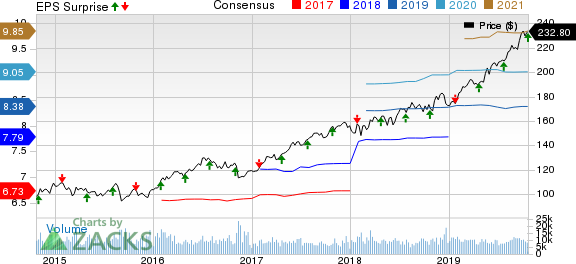

NextEra Energy, Inc. Price, Consensus and EPS Surprise

NextEra Energy, Inc. price-consensus-eps-surprise-chart | NextEra Energy, Inc. Quote

Total Revenues

In the third quarter, NextEra’s operating revenues were $5,572 million, surpassing the Zacks Consensus Estimate of $5,244 million by 6.3%. In addition, the reported revenues were up 26.2% year over year.

Segmental Results

Florida Power & Light Company: Revenues from the segment amounted to $3,491 million, up 2.7% from the prior-year figure of $3,399 million. The segment’s earnings came in at $1.40 per share, up 2.2% from $1.37 recorded in the prior-year quarter.

Gulf Power Company: Total segment revenues amounted to $440 million. This segment contributed 16 cents to its earnings in the reported quarter.

NextEra Energy Resources: Revenues from the segment amounted to $1,619 million, up 59% from the prior-year quarter. Quarterly earnings from the segment came in at 87 cents per share, up 19.2% from 73 cents in the year-ago quarter.

Corporate and Other: The segment’s operating loss in the reported quarter was 4 cents versus earnings of 7 cents in the year-ago period.

Highlights of the Release

In the reported quarter, NextEra Energy’s total operating expenses were up 15.4% from the prior-year level to $3,979 million.

Interest expenses in the quarter were $746 million, up a whopping 344.1% from the year-ago period.

In the reported quarter, Florida Power & Light Company’s total average customer count was up by 100,000 on a year-over-year basis.

NextEra Energy Resources expanded the contracted renewables backlog by adding 1,375 MW of renewable projects during third-quarter 2019.

Financial Update

NextEra Energy had cash and cash equivalents of $1,131 million as of Sep 30, 2019 compared with $638 million on Dec 31, 2018.

Long-term debt as of Sep 30, 2019 was $36.14 billion, up from $26.78 billion on Dec 31, 2018.

Cash flow from operating activities in the first nine months of 2019 was $6.24 billion compared with $5.2 billion in the comparable prior-year period.

Guidance

NextEra Energy reiterated its 2019 adjusted earnings guidance in the range of $8.00-$8.50. The company’s earnings are expected to grow at a compound annual rate of 6-8% per year through 2021, off its base of $7.70 in 2018. NextEra Energy expects 2022 adjusted earnings per share in the range of $10-$10.75, indicating 6-8% growth from 2021 EPS.

It plans to hike dividend by 12-14% per year through at least 2020, off a 2017 base of $3.93.

NextEra Energy currently aims to add 11,500-18,500 MW of renewable power projects in its portfolio within the 2019-2022 time frame.

Zacks Rank

Currently, NextEra Energy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

American Electric Power AEP is scheduled to announce third-quarter 2019 results on Oct 24. The Zacks Consensus Estimate for earnings per share for the to-be-reported quarter is pegged at $1.31.

Exelon Corp. EXC is slated to report third-quarter 2019 results on Oct 31. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings is pegged at $1.15 per share.

Dominion Energy D is scheduled to report third-quarter 2019 results on Nov 1. The Zacks Consensus Estimate for earnings for the quarter to be reported is pegged at 89 cents per share.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.50% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dominion Energy Inc. (D) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Exelon Corporation (EXC) : Free Stock Analysis Report

To read this article on Zacks.com click here.