NextEra Energy (NYSE:NEE) - Promising for Green Investors, Not Good Enough for Dividend Investors

This article first appeared on Simply Wall St News.

It is often thought that utility market prospects during turmoils, thus given the recent market optimism, it is not surprising to see a company like NextEra Energy, Inc. (NYSE: NEE) moving sideways for much of the year.

Yet, at an elevated P/E ratio of 49 – thanks to its ESG status, it is worth looking into this sector leader, more notably its dividend that has been growing steadily over time.

Check out our latest analysis on NextEra Energy.

The U.S. remains committed to restructuring its power grid in favor of greener sources of energy. The U.S Department of Energy sees the crucial role in solar power, while the Solar Futures Study shows it achieving as high as 45% of the power sources by 2050.

Although already being one of the largest produces of renewable energy, it is still a long road ahead for NextEra Energy, as it still generates over a third of its power from fossil fuels and non-renewables.

Meanwhile, the company is seeking to extend its Florida nuclear plant license. If the Nuclear Regulatory Commission grants these licenses, both reactors would be allowed to run for 80 years. Florida remains the largest domestic market for the company and the location of its headquarters.

The Dividend Outlook

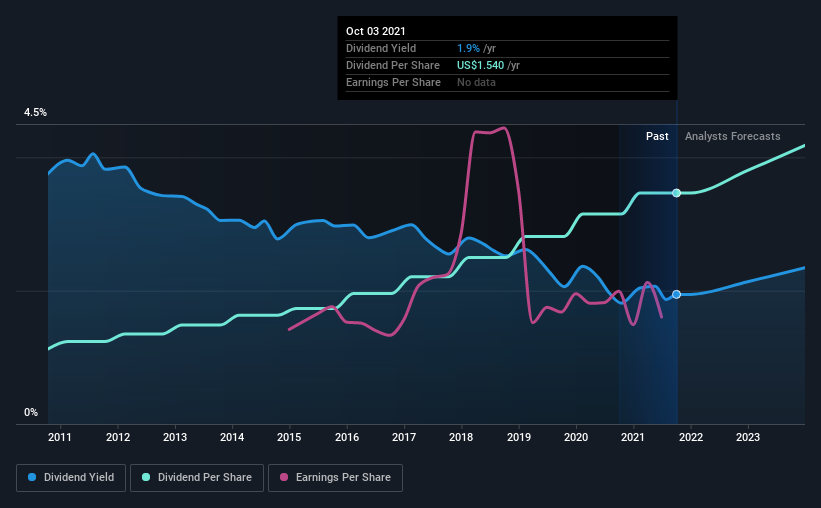

While NextEra Energy's 1.9% dividend yield is not the highest, we think its lengthy payment history is quite appealing.

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut.

As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of its net income after tax. NextEra Energy paid out 92% of its profit as dividends over the trailing twelve-month period.

Its payout ratio is relatively high, and earnings do not well cover the dividend. If earnings are growing or the company has a large cash balance, this might be sustainable - still, we think it is a concern.

We also measure dividends paid against a company's levered free cash flow to see if enough cash was generated to cover the dividend. Unfortunately, while NextEra Energy pays a dividend, it also reported negative free cash flow last year. While there may be a good reason for this, it's not ideal from a dividend perspective.

We update our data on NextEra Energy every 24 hours, so you can always get our latest analysis of its financial health here.

Dividend Volatility

One of the significant risks of relying on dividend income is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well. For this article, we only look at the last decade of NextEra Energy's dividend payments.

During this period, the dividend has been stable, implying the business could have relatively consistent earnings power. During the past 10-year period, the first annual payment was US$0.5 in 2011, compared to US$1.5 last year. Dividends per share have grown at approximately 12% per year over this time.

The rapid dividend growth with no notable cuts to the dividend over a lengthy period is a positive sign.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term.

NextEra Energy has grown its earnings per share at 2.7% per annum over the past five years. This level of earnings growth is low, and the company is paying out 92% of its profit. As they say in finance, 'past performance is not indicative of future performance.' Still, we are not confident a company with limited earnings growth and a high payout ratio will be a star dividend-payer over the next decade.

Conclusion

Dividend investors should always want to know if:

a dividend is affordable

there is a track record of consistent payments

the dividend is capable of growing

It's a concern to see that the company paid out a high percentage of its earnings and cash flow as dividends. Earnings growth has been limited, but at least the dividend payments have been relatively consistent.

With this information in mind, we think that there are better dividend opportunities on the market.

Market movements attest to how highly valued a consistent dividend policy is compared to a more unpredictable one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company.

Case in point: We've spotted 2 warning signs for NextEra Energy (of which 1 shouldn't be ignored!) you should know about.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com