NextGen Healthcare (NXGN) Loses 8.8% Despite Q3 Earnings Beat

Shares of NextGen Healthcare, Inc. NXGN fell 8.8% on Jan 28 despite better-than-expected third-quarter fiscal 2021 performance.

The company reported fiscal third-quarter adjusted earnings per share (EPS) of 26 cents, beating the Zacks Consensus Estimate of 24 cents by 8.3%. Moreover, the bottom line improved 13% from the prior-year quarter.

Revenue Details

Revenues amounted to $141.7 million, up 2.9% year over year. Also, the top line surpassed the Zacks Consensus Estimate by 0.6%.

Segment Details

The company reported third-quarter fiscal 2021 revenues under the following segments:

Total Recurring revenues were $128.2 million, up 2.8% from the year-ago quarter.

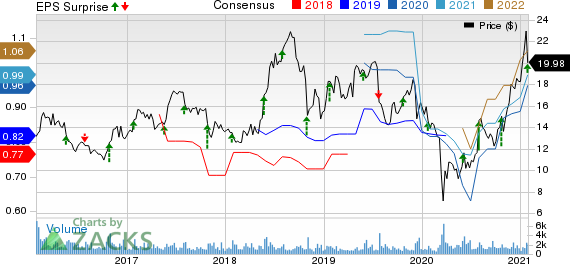

NEXTGEN HEALTHCARE, INC Price, Consensus and EPS Surprise

NEXTGEN HEALTHCARE, INC price-consensus-eps-surprise-chart | NEXTGEN HEALTHCARE, INC Quote

Meanwhile, total Software, hardware and other non-recurring revenues amounted to $13.5 million, up 4.3% on a year-over-year basis.

Margins

In the quarter under review, gross profit totaled $71.4 million, up 2.6% from the prior-year quarter. Gross margin was 50.4%, down 10 basis points (bps).

Operating profit came in at $0.9 million, down 71.6% year over year.

Operating margin in the fiscal third quarter was 0.7%, up 170 bps.

Cash Position

Cash and cash equivalents were $89.5 million at the end of the fiscal third quarter, compared with $103.4 million at the end of the fiscal second quarter.

At the end of fiscal third quarter, cumulative net cash flow from operations came in at $75.9 million, compared with $64.4 million a year ago.

Fiscal 2021 Guidance

On the back of improvement in market conditions, NextGen Healthcare is reiterating its annual guidance.

The company projects revenues in the range of $547 million to $555 million. The Zacks Consensus Estimate for the same is pegged at $549.6 million.

Adjusted EPS is projected within 92-98 cents. The Zacks Consensus Estimate for the same is pegged at 96 cents.

Summing Up

NextGen Healthcare exited the fiscal third quarter on a strong note. The company benefited from its operating segments in the quarter under review. Expansion in adjusted operating margin is another plus. However, significant contraction in gross margin remains a concern. Additionally, NextGen Healthcare faces intense competition in the MedTech space.

Zacks Rank

NextGen Healthcare currently carries a Zacks Rank #2 (Buy).

Other Key Picks

Some other top-ranked stocks, which are expected to report earnings soon, include Hologic, Inc. HOLX, IDEXX Laboratories, Inc. IDXX and Align Technology, Inc. ALGN.

The Zacks Consensus Estimate for Hologic's first-quarter fiscal 2021 adjusted EPS is pegged at $2.14, indicating a whopping increase of 250.8% from the year-ago quarter. The company currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

IDEXX currently carries a Zacks Rank of 2. The Zacks Consensus Estimate for fourth-quarter 2020 adjusted EPS currently stands at $1.43, indicating growth of 37.5% from the prior-year quarter. The consensus estimate for revenues is pegged at $677.5 million, suggesting 12.2% increase from the year-ago reported figure.

The Zacks Consensus Estimate for Align Technology’s fourth-quarter 2020 revenues is pegged at $781.9 million, suggesting an improvement of 20.3% from the year-earlier reported figure. The same for EPS stands at $2.13, indicating growth of 39.2% from the year-ago reported figure. The company currently carries a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research