Is NIO Still a Compelling EV Play After Reporting Strong Earnings?

Nio’s (NIO) recent earnings report on April 29 was probably about as good as investors could have asked for. This Chinese EV maker reported a relatively positive beat.

Since that date, though, NIO stock has been on quite the downward trend. Since opening around $41 per share on April 30, NIO stock has sold off approximately 17% over the past couple of weeks.

It appears that a confluence of factors is driving NIO stock. Let’s dive into what’s going on with this stock right now.

Strong Earnings Paint Positive Picture for NIO Stock

Nio’s earning call was relatively upbeat. The company beat on the top line, bringing in 8 billion Yuan compared to average analyst estimates of 7.5 billion Yuan. However, the real strength in Nio’s earnings report was its gross margin improvement.

Investors sometimes forget that electric vehicles are still vehicles. Gross margins are just as important to EV stocks as to stocks of traditional ICE (internal combustion engine) automakers. Accordingly, this is a key metric that many investors pay close attention to, as a prediction of forward profitability.

Nio earns an A on this metric. The company reported a substantial gross margin improvement this past quarter. Its gross margin of 19.5% is much higher than the market expected and 3% higher than the same quarter last year. (See NIO stock analysis on TipRanks)

Nio appears to be well-positioned to grow in a Chinese economy with a booming middle class and an EV-focused government mandate. As the golden child of the Chinese EV space, the company is set to grow profitably.

Valuation Concerns Remain for Investors

Nio’s earnings were undoubtedly strong. However, as we’ve seen with other big tech names of late, great doesn’t seem to be good enough.

Investors aren’t only expecting an earnings beat. They’re expecting massive beats, share buybacks, and improved forward guidance.

Here’s where NIO stock has stumbled thus far. The company reported a top-line beat of “only” 6.7%, which is not significant enough for many investors.

Additionally, Nio provided investors with relatively bearish forward guidance prior to earnings. Concerns about global chip shortages have plagued the entire sector, and Nio reflected this in its forward guidance. NIO stock started to sell off even before earnings were announced.

Indeed, this indicates just how perfectly priced equities are today. Nio is a great growth stock. However, today's investors aren’t only pricing in market-beating growth into stocks like Nio. They’re pricing in massive blowout earnings and an acceleration of growth.

Wall Street's Take

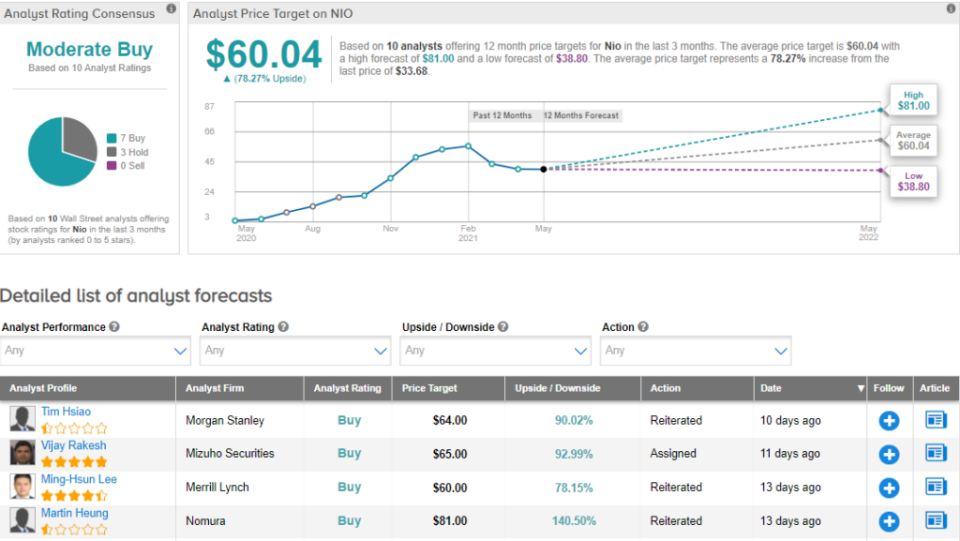

Consensus among analysts for NIO is a Moderate Buy with 7 Buy and 3 Hold ratings. The stock has an average analyst price target of $60.40, which implies 78.27% upside potential over the next 12 months.

Bottom Line

Nio is one of those hyper-growth stocks that investors need to keep on their radar. This is a stock with all the catalysts in its favor right now. It isn’t just growing – it’s growing fast, and profitably.

Nio’s position as a tech and EV play is working to its disadvantage right now. The market is selling off speculative names, and throwing excellent growth stocks out with the bathwater. Accordingly, Nio’s near-50% discount to its all-time high could be a great buying opportunity for long-term investors.

Disclosure: Chris MacDonald held no position in any of the stocks mentioned in this article at the time of publication.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.