The No-Brainer Stock Warren Buffett Should Buy

Chalk up another ridiculously successful year for the greatest buy-and-hold investor of our generation, Warren Buffett. This past weekend, Buffett released his annual letter to shareholders, highlighting an absurdly strong 23% increase in Berkshire Hathaway's (NYSE: BRK-A)(NYSE: BRK-B) book value, which in dollar terms translates to $65.3 billion. It should be noted that $29 billion was the result of a change in U.S. tax code, while $36 billion was generated by Berkshire's dozens of owned enterprises.

However, the number that really stood out in Buffett's annual report to shareholders was the massive amount of capital the company has on hand for acquisitions. Berkshire ended 2017 with $116 billion in cash and short-term Treasuries notes, up almost $30 billion from where it ended 2016. The issue is that Buffett and his team simply haven't found the right acquisition(s) worthy of deploying that capital as of yet. But make no mistake about it, Buffett is looking to boost earnings for Berkshire's non-insurance group.

Image source: The Motley Fool via Flickr.

Said Buffett:

Berkshire's goal is to substantially increase the earnings of its non-insurance group. For that to happen, we will need to make one or more huge acquisitions. We certainly have the resources to do so. This extraordinary liquidity earns only a pittance and is far beyond the level Charlie [Munger] and I wish Berkshire to have. Our smiles will broaden when we have redeployed Berkshire's excess funds into more productive assets.

The no-brainer stock Buffett should buy

While there's been abundant speculation as to what companies might be on Buffett's acquisition list, there's one no-brainer stock that stands out to this investor as perfect for Buffett to buy: NextEra Energy (NYSE: NEE).

NextEra Energy is currently the largest publicly traded utility by market cap at nearly $73 billion. It's a utility monster, employing around 14,000 people across 33 states, as well as in Canada, and sporting a net generating capacity of 47,000 megawatts (MW) at the end of the year. But it's not NextEra's size that's the main lure for Buffett. Rather, I suspect it would be the following five factors.

Image source: Getty Images.

1. It's a basic need, and Buffett loves basic needs

To begin with, the electric utility industry offers a basic-need product: electricity. If you own a home or condo, or rent an apartment, chances are extremely good that you need electricity to live comfortably.

Utilities also typically have a monopoly or oligopoly on a specified region. For instance, if you want electricity or water service, chances are that you have only one or two providers to choose from. This selectivity generally ensures that utilities like NextEra Energy have sufficient pricing power to stay ahead of inflation, as well as predictable demand and cash flow. Buffett absolutely loves investing in companies and industries where demand and growth are predictable.

2. It fits with Berkshire Hathaway Energy's long-term strategy

Second, acquiring NextEra Energy would fit well with Berkshire Hathaway Energy, which already has 10 subsidiaries operating in the electricity, transmission, and natural gas industries across the United States. NextEra would immediately boost Berkshire Hathaway Energy's total customers served -- Florida Power & Light alone would add approximately 5 million customers -- and it would fit with the theme of purchasing energy businesses with a focus on renewable energy, which will be discussed a bit more in the point below.

For instance, Berkshire's acquisition of Nevada's NV Energy in 2013 is a perfect example of targeting growth and renewable energy. Buffett bought NV Energy with the expectation that it would allow Berkshire to take advantage of Nevada's rapidly growing economy, as well as utilize NV Energy for solar projects in Nevada's warm and sunny deserts.

Image source: Getty Images.

3. NextEra's solar and renewable platform is unmatched

An even more attractive reason for Buffett to deploy his capital on NextEra Energy is its leading renewable energy platform. Last year, approximately 2,150 MW of wind and solar projects were commissioned in the U.S., with a record 2,700 MW of new wind and solar projects added to its backlog. The company currently has approximately 7,000 MW of backlogged wind and solar projects between 2017 and 2020, which is the largest four-year backlog in its history, with management expecting this backlog to increase to 10,100 MW-16,500 MW between 2017 and 2020. This could include as much as 7,800 MW of wind power, 4,300 MW in wind repowering projects, and up to 3,800 MW of solar generating capacity.

Why care about renewable energy? Though these projects aren't cheap on the front end, they can dramatically reduce costs over the long term, putting NextEra at a clear advantage relative to its peers. In fact, the recently passed tax reforms have the potential to keep Florida Power & Light's rate agreement intact through 2022, which is going to mean a lot of happy customers paying reasonably low and stable electricity rates.

4. Regulation in all the right places

Fourth, Buffett would appreciate that NextEra Energy primarily operates in markets that are regulated by an energy commission. On the surface, this might not seem too ideal because it means that rate increases need to be approved by a regulatory energy commission before they can be enacted. However, it also means that certain NextEra subsidiaries, such as Florida Power & Light, aren't exposed to what can be wildly fluctuating electricity prices in the wholesale market. This regulation helps ensure steady and predictable consumer demand and cash flow for its traditional operations.

Meanwhile, its NextEra Energy Resources division, which incorporates its renewable energy projects, isn't regulated (i.e., it's competitive, with electricity prices moving up and down based on demand). That, of course, isn't too big a deal since these lower-cost sources of electricity generation tend to be in high demand.

5. A lengthy history of sustainable growth

Last, but not least, NextEra has delivered consistent growth over the years with its time-tested business model.

Last year, NextEra Energy generated 8.2% year-on-year earnings-per-share growth, and it anticipates growing its net income by between 6% and 8% a year through 2021. That's ambitious considering that most electric utilities tend to grow their profits in the low to mid single digits, but it's also reflective of the investments it has made in renewable energy, which have helped boost its margin. In fact, management is so confident in the company's future that it announced plans to increase its dividend by between 12% and 14% a year through at least 2020.

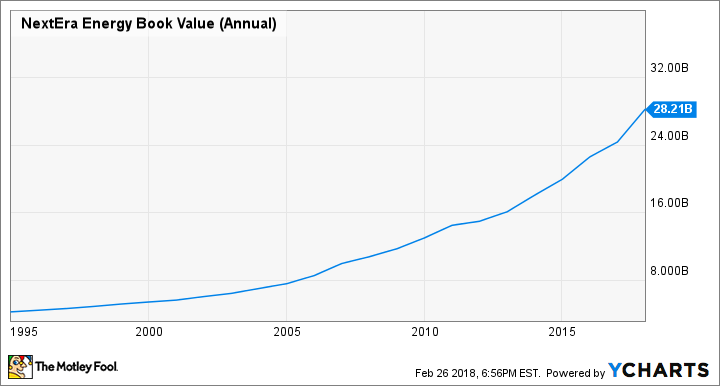

NEE Book Value (Annual) data by YCharts.

As you can see from the chart above, NextEra has also increased its book value every year for the past 22 years. This is a business model that's been lucky enough to have a strong management team, but which could thrive even with someone subpar at the helm.

There is a drawback, but it shouldn't stop Buffett

Perhaps the only drawback for Buffett would be that NextEra is currently valued at 12 times its enterprise value (market cap plus total debt) divided by EBITDA (earnings before interest, taxes, depreciation, and amortization). Most of its large rivals, including Consolidated Edison, Duke Energy, and American Electric Power, are all valued at roughly 10 times their enterprise value divided by EBITDA. In other words, its rivals appear cheaper, and Buffett is usually looking for bargains.

However, I don't think this would be enough to stand in the way of Buffett considering a NextEra Energy acquisition. As noted, the company's renewable energy program is unmatched, meaning the premium Buffett would be paying is likely well deserved. Where else can you get 6% to 8% compound annual growth and 12% to 14% annual dividend growth in the electric utility industry? To me, at least, this would be a no-brainer buy for the Oracle of Omaha.

More From The Motley Fool

Sean Williams has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Berkshire Hathaway (B shares). The Motley Fool has a disclosure policy.