Norfolk Southern Does the Little Things Right to Grow Q3 Earnings 13%

A railroad business has to do one thing well to be a great investment: Be efficient. Norfolk Southern (NYSE: NSC) has never had a reputation as an efficient operator, but the company's third-quarter results suggest we should start to reconsider how we view its position in the industry. After several consecutive quarters of efficiency gains, the company posted an impressive jump in EPS.

Let's take a look at the company's most recent results and why investors may want to rethink their views on the company.

Image source: Getty Images.

By the numbers

Metric | Q3 2017 | Q3 2016 |

|---|---|---|

Revenue | $2.67 billion | $2.52 billion |

Operating income | $911 million | $820 million |

Net income | $506 million | $460 million |

Diluted earnings per share | $1.75 | $1.55 |

Data source: Norfolk Southern earnings release.

Double-digit net income growth is a significant achievement for most railroad companies, and Norfolk Southern delivered a 12.8% increase in earnings per share compared to last year. A combination of higher revenue (up 6%), operating expenses that increased at a slower pace than revenue (up 3%), and a lower share count from share repurchases (down 2%) led to the improved result.

Compared to its railroad peers, Norfolk Southern's revenue growth doesn't stand out that much. Of the major railroad companies that have reported thus far, Norfolk's 6% revenue gain puts it right in the middle of the pack. What should be noted, though, is that the one laggard in revenue growth just happens to be Norfolk Southern's most direct competitor, CSX (NASDAQ: CSX). The company reported only 1% revenue growth in the most recent quarter and its operations have taken a severe hit lately as CEO Hunter Harrison tries to implement deep cost-cutting. It would seem that perhaps Norfolk Southern's gains are at the expense of CSX.

The gains in revenue were evenly spread among its three segments: merchandise, intermodal, and coal. Higher industrial production, construction activity, higher coal exports, and a tightening supply of trucking for intermodal transport all drove the better results.

Norfolk Southern posted an operating ratio of 65.9%. Compared to the rest of the railroad industry, that isn't a splendid number. As management noted, though, that was a 160-basis-point improvement compared to this time last year and its the lowest reported operating ratio in company's history.

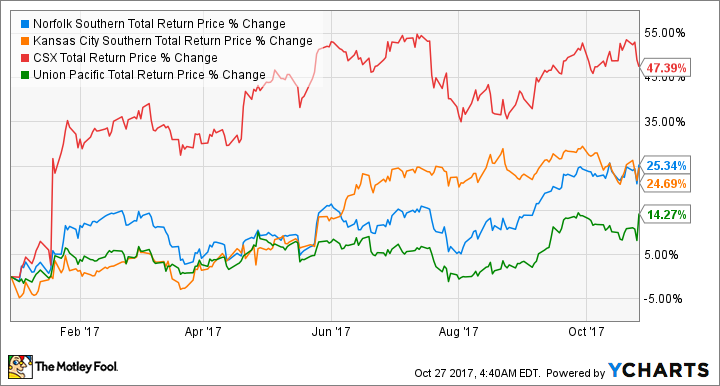

NSC Total Return Price data by YCharts.

What management had to say

In the company's press release, CEO James Squires highlighted the gains the company has made in improving operations and making Norfolk Southern more competitive: "Norfolk Southern continues to deliver strong financial results through execution of our strategic plan. We are unwavering in our commitment to improve productivity as demonstrated by seven consecutive quarters of year-over-year improvement in our operating ratio."

What a Fool believes

It's funny. CSX got a lot of attention when Harrison took the reins and promised to cut costs and get the company's operating ratio into the mid-60s. Norfolk Southern, on the other hand, didn't get nearly as much attention yet has improved its operating ratio from the low 70s to the mid-60s with little fanfare. This past quarter shows that the company is not only performing well, but it's possible that it is benefiting from CSX's recent turmoil. With Norfolk Southern's stock trading at a sizable discount to CSX's today, Norfolk Southern is looking like a much better investment.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool recommends CSX. The Motley Fool has a disclosure policy.