North American Segment Drives General Motors (GM) Q3 Earnings

General Motors (GM) delivered a comprehensive beatin the third quarter of 2019, with earnings and sales surpassing the Zacks Consensus Estimate. Better-than-expected performance from the North American market led to the outperformance. The company’s top peer, Ford F also delivered earnings and sales beat in third-quarter 2019 due to strong North American market.

General Motors reported adjusted earnings of $1.72 per share in third-quarter 2019, topping the Zacks Consensus Estimate of $1.18. However, the bottom line declined 8% from the year-ago figure. The top U.S. carmaker firm reported revenues of $35,473 million, topping the Zacks Consensus Estimate of $34,153 million. However, the top line decreased from the year-ago figure of $35,791 million.

The automaker’s global market share was 10.7% in the reported quarter, reflecting a marginal decline from 10.8% in the year-ago period.

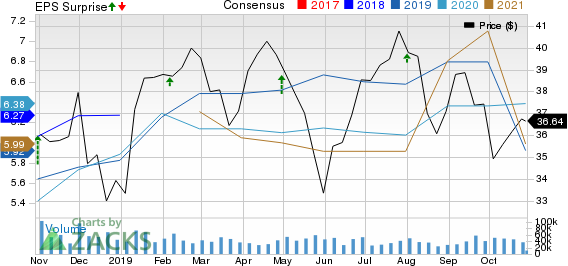

General Motors Company Price, Consensus and EPS Surprise

General Motors Company price-consensus-eps-surprise-chart | General Motors Company Quote

Segment Results

GM North America (GMNA) generated net sales and revenues of $27.9 billion in third-quarter 2019, up from $27.6 billion recorded in the corresponding period of 2018. Revenues from the GMNA unit also outpaced the Zacks Consensus Estimate of $25.7 billion. Profits from the segment recorded a year-over-year increase of 7% to $3 billion in the quarter under review. Moreover, the figure surpassed the Zacks Consensus Estimate of $2.5 billion. Robust sales of trucks and crossovers drove the results of the unit. Higher year-over-year pricing of all new pickups also aided the performance. Notably, vehicle sales in the United States came in at 739,000 units, reflecting a year-over-year increase of 6%. Deliveries increased across all its brands, with crossovers generating record sales in the quarter.

GM International’s (GMI) net sales and revenues were $3.8 billion, declining from $4.6 billion in the year-ago quarter. Revenues from the GMI segment also lagged the Zacks Consensus Estimate of $4.2 billion. The unit recorded an operating loss of $65 million against income of $139 million a year ago. The Zacks Consensus Estimate for segmental earnings was $112 million. Sagging vehicle sales in China amid economic slowdown and trade tussle negatively impacted the segment.

GM Financial generated net sales and revenues of $3.66 billion in the quarter under review, reflecting a rise from $3.51 billion recorded in the year-ago period. The segment recorded operating profit of $711 million, significantly beating the Zacks Consensus Estimate of $469 million. The figure also increased 42.7% year over year.

Dividend & Financials

General Motors recently declared fourth-quarter dividend of 38 cents a share, payable on Dec 19 to its shareholders as of Dec 6, 2019.

General Motors had cash and cash equivalents of $20.1 billion as of Sep 30, 2019 compared with $20.8 billion on Dec 31, 2018. Long term automotive debt stands at $13.1 billion.

Adjusted automotive free cash flow in the reported quarter was $3.8 billion, representing a massive increase from $396 million in the prior-year period.

Guidance

General Motors expects full-year capex to come in at $7.5 billion, lower than the prior projection. Amid the impact of UAW strike, the company has revised its full-year view. It now forecasts adjusted EPS between $4.50 and $4.80 per share. The company expects adjusted automotive free cash flow within $1 billion.

Zacks Rank & Key Picks

General Motors currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the auto space are Polaris Industries Inc. PII and Tesla, Inc. TSLA, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Ford Motor Company (F) : Free Stock Analysis Report

Polaris Industries Inc. (PII) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research