Northrop Grumman Crushes on Earnings. Investors Cheer -- Then Jeer

Northrop Grumman (NYSE: NOC) reported its fiscal Q3 2017 earnings on Wednesday, and the headline numbers, at least, were pretty terrific. Expected to report $2.92 per share in profit, Northrop instead delivered $3.68. Sales similarly surpassed expectations for $6.32 billion, coming in instead at $6.53 billion.

As you'd expect, investors were pretty pleased with the results, bidding Northrop Grumman shares up by more than 3% on the day earnings were released. Within just 24 hours, however, investors rethought their enthusiasm and took back more than half those gains. As of this writing, Northrop Grumman stock sells for $298 a share -- just 1.4% above its pre-earnings price.

Want to know why? Let's start with a quick review of the numbers.

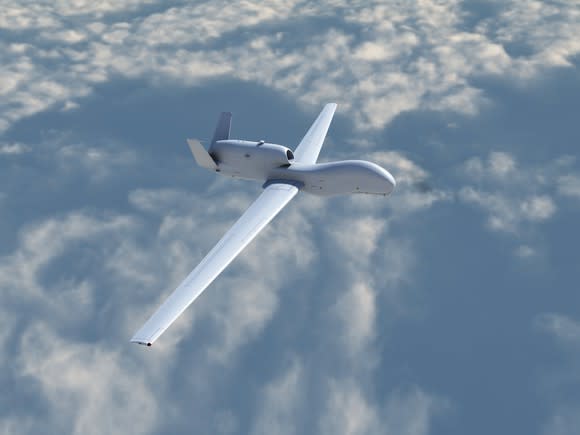

Northrop Grumman makes big Global Hawk military drones -- and it made bigger profits last quarter, too. Image source: Getty Images.

Northrop by the numbers

In Q3, Northrop Grumman grew its quarterly sales 6% to $6.5 billion. Operating profit margin, however, shed 50 basis points, falling to 12.9%. As a result, operating profit grew only 2%. But thanks to a lower tax rate paid in the quarter, net profit margin expanded right back again, helping Northrop Grumman to arrive at $3.68 per share on the bottom line -- 10% better than last year.

Pretty good news, huh? But no matter how good the end result, it's important to take note of what happened with operating margin. Remember how I said last quarter that Northrop Grumman's operating profit margin was nearing an all-time high, and at risk of falling? Well, it just fell, and the longer it keeps falling, the more Northrop Grumman will need to depend on revenue growth to keep its overall profit growing.

Absorbing Orbital ATK

In fact, that need to keep revenue growing may provide the subtext underlying Northrop's recent decision to acquire missile specialist Orbital ATK (NYSE: OA). I think the price Northrop is paying for Orbital -- $7.8 billion plus an assumed $1.4 billion in debt -- is a mite steep at a valuation of more than two times sales. Then again, Northrop Grumman stock itself now sells for an enterprise value of 2.3 times trailing sales. (And all across the defense industry, valuations have become pretty extreme.)

One thing I can't deny: Buying Orbital ATK is a quick way of adding $4.5 billion in annual sales to Northrop Grumman's revenue stream. And with Orbital earning only 10% operating margins on these revenues on its own, Northrop should be able to extract additional profits from these revenues simply by cutting out $150 million in costs , and raising its new subsidiary's margins closer to its own 13.3% level of operating profitability.

The upshot for investors

Assuming it can do that, I think it's at least possible Northrop will be able to offset any future declines in the profitability of its core business by adding more revenue from Orbital, and improving the profit margin earned on that additional revenue.

Of course, it still remains to be seen whether any improvements Northrop Grumman will make can justify the stock's already high valuations of 2.3 times sales, 23 times earnings, and more than 27 times free cash flow. I think the stock is too richly priced today and more likely to fall than rise, and investors' mixed reaction to this week's earnings report suggest they're beginning to have their doubts as well.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Rich Smith has no position in any of the stocks mentioned. The Motley Fool recommends Orbital ATK. The Motley Fool has a disclosure policy.