Northrop Grumman (NOC) Misses Q1 Earnings, Cuts '20 EPS View

Northrop Grumman Corporation NOC reported first-quarter 2020 earnings of $5.15 per share, which missed the Zacks Consensus Estimate of $5.42 by 5%. However, the bottom line rose 1.8% from $5.06 in the year-ago quarter.

Total Sales

Northrop Grumman reported total salesof $8,620 million for the first quarter, surpassing the Zacks Consensus Estimate of $8,474 million by 1.7%. Moreover, revenues increased 5.3% from the year-ago quarter’s $8,189 million. The year-over-year upside was primarily driven by an 8% increase in Space Systems sales, 6% in Defense Systems sales and 6% in Mission Systems sales.

Backlog Count

Northrop Grumman’s total backlog stood at $64.17 billion at the end of first-quarter 2020, compared with $64.84 billion at 2019-end. Of the total backlog, $32.52 billion was funded.

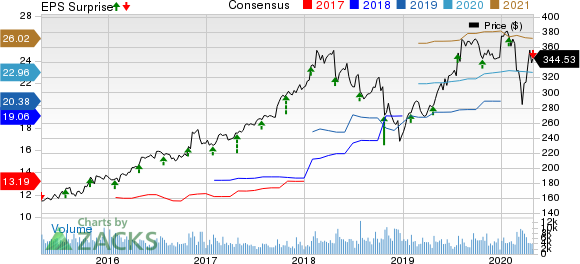

Northrop Grumman Corporation Price, Consensus and EPS Surprise

Northrop Grumman Corporation price-consensus-eps-surprise-chart | Northrop Grumman Corporation Quote

Segmental Details

Effective Jan 1, 2020, Northrop made some structural changes in its reportable segments. Here are its new segments:

Aeronautics Systems: Segment sales of $2,843 million grew 1% year over year as a result of higher sales from both autonomous systems and manned aircraft.

Operating income declined 16% to $259 million, whereas operating margin contracted 180 basis points (bps) to 9.1%.

Mission Systems: Segment sales increased 6% to $2,340 million driven by higher sales volume from airborne sensors and networks along with maritime/land systems and sensors programs.

Operating income rose 9% to $348 million, with operating margin expanding 40 bps to 14.8%.

Defense Systems: Sales at this segment improved 6% to $1,881 milliondue to higher sales of battle management and missile systems as well as mission readiness.

Operating income declined 3% to $196 million, with operating margin contracting 10 bps to 10.4%.

Space Systems: Space Systems’ first-quarter 2020 sales increased 8% to $1,948 million owing to higher sales from the Space program.

The segment’s operating income improved 6% to $199 million whileoperating margin contracted 20 bps to 10.2%.

Operational Update

Total operating costs and expenses at the end of the quarter were $7,686 million, up 6%.

Operating income during the quarter slipped 0.2% to $934 million.

Financial Condition

Northrop Grumman’s cash and cash equivalents, as of Mar 31, 2020, were $3,278 million, up from $2,245 million, as of Dec 31, 2019.

Long-term debt (net of current portion), as of Mar 31, 2020, was $14,299 million, up from $12,770 million, as of 2019-end.

Net cash outflow from operating activities, as of Mar 31, 2020, was $993 million compared with $913 million, as of Mar 31, 2019.

2020 Guidance

Considering the global impact of the COVID-19 pandemic, Northrop Grumman has lowered its 2020 revenue and earnings guidance. The company currently expects to generate revenues in the range of $35.0-$35.4 billion, compared with its prior guidance range of $35.3-$35.8 billion during 2020. The Zacks Consensus Estimate of $35.63 billion is higher than the midpoint of the company provided guidance range.

The company’s 2020 earnings are currently expected to be in the range of $21.80-$22.20 per share, compared with the previous band of $22.75-$23.15 per share. The Zacks Consensus Estimate of $22.97 is higher than the company provided guidance range.

The company however continues to expect free cash flow of $3.15-$3.45 billion in 2020.

Zacks Rank

Northrop Grumman currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Teledyne Technologies Inc. TDY reported first-quarter 2020 earnings of $2.28 per share, which surpassed the Zacks Consensus Estimate of $2.10 by 8.6%.

Lockheed Martin Corp. LMT reported first-quarter 2020 earnings of $6.08 per share, which surpassed the Zacks Consensus Estimate of $5.76 by 5.5%.

Hexcel Corporation HXL reported first-quarter 2020 adjusted earnings of 64 cents per share, which missed the Zacks Consensus Estimate of 67 cents by 4.5%.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research