It’s not Cheap to Hedge Russia ETFs

As tensions flare in Ukraine, traders are paying up to hedge against losses in exchange traded funds holding Russian equities.

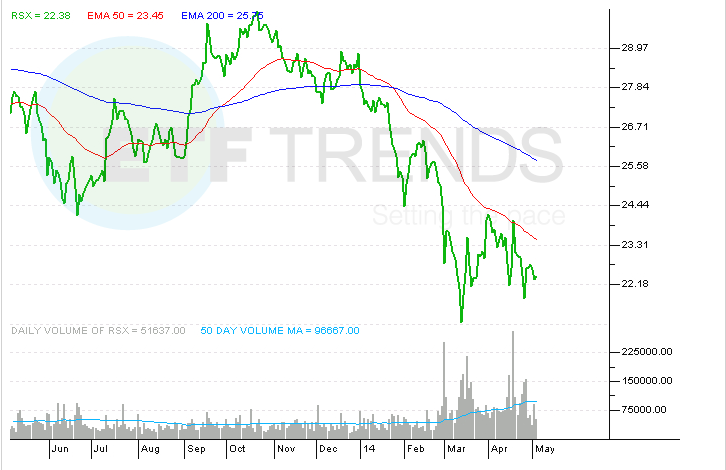

With the benefit of 2.3% gain Tuesday, the Market Vectors Russia ETF (RSX) is down 1.3% over the past month, but that loss grows to 4.4% when measured from April 17.

Since then pro-Russian separatists have flexed increasing power in Ukriane and Standard & Poor’s lowered its rating on Russian sovereign debt to BBB-, the lowest investment grade. That was the first time the ratings agency downgraded Russia since 2008. [Russia ETFs Drop After Downgrade]

Geopolitical tensions are forcing traders to pay up to hedge losses in RSX, the most heavily traded Russia ETF and also the Russia ETF with the most robust options market.

Costs of protecting RSX against further downside “rose to an all-time high relative to emerging-market stocks, based on implied-volatility data for options,” Bloomberg reported. “Implied volatility, the key gauge of options prices, for contracts with an exercise level closest to RSX” has surged 33% since the start of March, according to Bloomberg.

As has been the case throughout the Ukraine crisis, leveraged Russia ETFs have seen upticks in activity and volatility as tensions have mounted. [Leveraged Russia ETFs in Focus]

The Direxion Daily Russia Bear 3x Shares (RUSS) is the second-best bearish performer this month among Direxion’s deep stable of leveraged products. Its 30-day realized volatility is 113.28 while the Direxion Daily Russia Bull 3x Shares (RUSL) has 30-day realized volatility of 108.24, according to Direxion data.

Both ETFs have seen positive creation activity over the past 30 days.

Russian equities are among the cheapest in the world and are heavily discounted not only to the broader emerging markets universe, but also by their own historical standards. Russia’s benchmark Micex trades at less than five times earnings, roughly half the P/E ratio seen on the MSCI Emerging Markets Index. [Big Risks, Potential With Small Russia ETF]

Market Vectors Russia ETF

ETF Trends editorial team contributed to this post.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.