November Top Growth Stocks

High-growth stocks that are financially stable are attractive for many reasons. They provide a strong upside to your portfolio, with less likelihood of downside risks compared to less financially robust companies. If your holdings could benefit from diversification towards growth stocks, whether it be in reputable tech stocks or green small-caps, take a look at my list of stocks with a bright future ahead.

Incyte Corporation (NASDAQ:INCY)

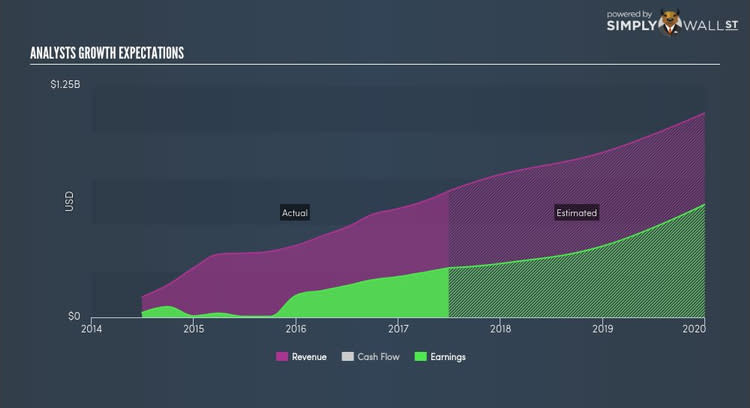

Incyte Corporation focuses on the discovery, development, and commercialization of proprietary therapeutics in oncology in the United States and internationally. Started in 1991, and currently lead by Hervé Hoppenot, the company now has 980 employees and with the company’s market capitalisation at USD $22.48B, we can put it in the large-cap category.

Extreme optimism for INCY, as market analysts projected an outstanding earnings growth rate of 91.49% for the stock, supported by a double-digit sales growth of 41.60%. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with high top-line expansion. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 22.35%. INCY’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Considering INCY as a potential investment? Have a browse through its key fundamentals here.

TPI Composites, Inc. (NASDAQ:TPIC)

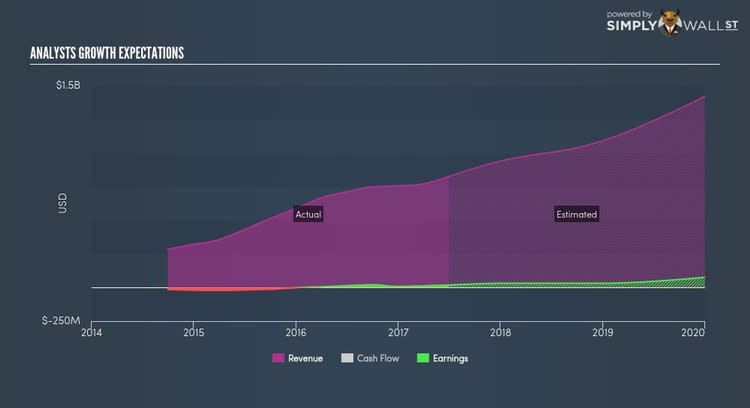

TPI Composites, Inc. manufactures and sells composite wind blades, and related precision molding and assembly systems to original equipment manufacturers. Started in 1968, and currently lead by Steven Lockard, the company now has 6,700 employees and with the stock’s market cap sitting at USD $805.71M, it comes under the small-cap group.

Extreme optimism for TPIC, as market analysts projected an outstanding earnings growth, which is expected to more than double, supported by an equally strong sales growth of 52.13%. It appears that TPIC’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 28.54%. TPIC’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Could this stock be your next pick? Check out its fundamental factors here.

Antero Midstream Partners LP (NYSE:AM)

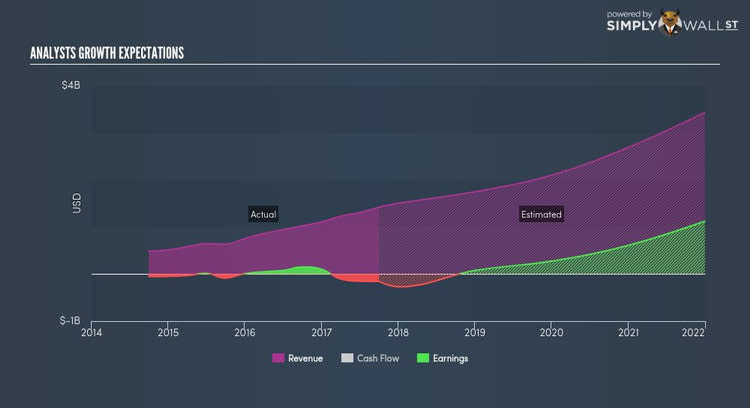

Antero Midstream Partners LP owns, operates, and develops midstream energy assets. Antero Midstream Partners was formed in 2013 and with the company’s market cap sitting at USD $5.86B, it falls under the mid-cap category.

Extreme optimism for AM, as market analysts projected an outstanding earnings growth rate of 85.70% for the stock, supported by a double-digit sales growth of 45.90%. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with high top-line expansion. We see this bottom-line expansion directly benefiting shareholders, with expected return on equity coming in at a notable 23.60%. AM ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Could this stock be your next pick? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.