Novo Nordisk (NVO) Beats Q1 Earnings Estimates, Sales Miss

Novo Nordisk A/S NVO reported first-quarter 2018 earnings of 73 cents per American Depositary Receipt (“ADR”) exceeding the Zacks Consensus Estimate of 69 cents. The reported figure was higher than 58 cents earned in the year-ago period.

Quarterly revenues were up 9% year over year (up 5% in local currency) to $4.45 billion. The top line missed the Zacks Consensus Estimate of $4.49 billion.

Year to date, Novo Nordisk’s shares have lost 5.5% compared with the industry’s decline of 3.2%.

All growth rates mentioned below are on a year-over-year basis and in local currency.

Quarter in Detail

Novo Nordisk operates through two segments: Diabetes and obesity care, and Biopharmaceuticals.

In the quarter, sales increased in diabetes care and obesity with the majority of growth originating from Victoza, Tresiba and Saxenda, partly offset by declining sales of Levemir. Revenue growth within biopharmaceuticals was driven by increased sales of NovoEight and NovoSeven, partly offset by Other biopharmaceuticals. International Operations and North America Operations contributed to sales growth with 70% and 30% respectively.

The Diabetes and Obesity Care segment recorded sales growth of 6% in local currency in the quarter. Sales of insulin decreased remained unchanged in local currencies. Sales of long-acting insulin (Tresiba, Xultophy and Levemir) decreased by 3% in local currencies to DKK 4,873 million.

Nevertheless, sales at the Biopharmaceuticals segment increased 1%. Hemophilia sales were up 7%.

Research and development (R&D) expenses were up 5%, due to higher expenses for the diabetes care and obesity portfolio. The increase in development costs was predominantly driven by the phase 3b SUSTAIN program for Ozempic.

Administrative costs also remained unchanged in local currencies, mainly due to general cost-control initiatives.

Sales and distribution costs increased by 5%, mainly reflecting higher promotional activities in both International Operations and North America Operations to support Victoza and Saxenda as well as the launch activities for Ozempic, especially in the United States, partly offset by lower costs for legal cases.

Pipeline Update

In February 2018,Novo Nordisk announced that the European Commission (EC) granted marketing authorisation for Ozempic (subcutaneous semaglutide) for the treatment of adults with type II diabetes.

In February, Novo Nordisk successfully completed the first phase IIIa trial, PIONEER 1, with oral semaglutide for treatment of adults with type II diabetes. The trial achieved its primary objective by demonstrating statistically significant and superior improvements in blood glucose levels (HbA1c) for all three doses of oral semaglutide compared to placebo.

In March 2018, Novo Nordisk announced that the Japanese Ministry of Health, Labour and Welfare has approved Ozempic based on results from the SUSTAIN clinical trial program. The approval was based on the results from five SUSTAIN trials, including approximately 1,200 adults from Japan.

In April 2018, the company submitted a supplemental new drug application (sNDA) to the FDA for including data from the LEADER and DEVOTE cardiovascular outcomes trials in the product information of Xultophy 100/3.6.

2018 Outlook

Novo Nordisk expects sales growth (in local currencies) to be in the range of 3-5% up from the previous guidance of 2-5%. This reflects strong performance for the portfolio of new-generation insulin and the GLP-1 portfolio, now comprising both Victoza and Ozempic as well as a solid contribution from Saxenda. However, sales growth is expected to be partly countered by intensifying global competition both within diabetes care and biopharmaceuticals, especially within the haemophilia inhibitor segment, as well as continued pricing pressure within diabetes care, especially in the United States.A negative currency impact of 6 percentage points is expected as well.

Operating profit growth is anticipated to be in the range of 2-5% up from the previous expectation of 1-5% reflecting the outlook for sales growth and an impact from continued focus on cost control. The outlook also reflects a planned increase in the sales and distribution costs to support the commercialization efforts for Ozempic. A negative currency impact of 9 percentage points is expected as well.

Capital expenditure is expected to be around DKK 9.5 billion in 2018, primarily related to investments in additional capacity for active pharmaceutical ingredient production within diabetes care and an expansion of the diabetes care filling capacity.

Our Take

Novo Nordisk’s first-quarter results beat earnings but missed revenue estimates.

Continued growth from Victoza and Tresiba as well as higher contributions from Saxenda and Xultophy are likely to be partly offset by the impact of lower realized prices in the Unites States, loss of exclusivity for products in hormone replacement therapy, intensifying competition within the diabetes and biopharmaceuticals markets, besides macroeconomic conditions in many markets under International Operations.

Zacks Rank & Stocks to Consider

Novo Nordisk is a Zacks Rank #3 (Hold) stock.

A few better-ranked stocks from the same space worth considering are Ligand Pharmaceuticals LGND, Protagonist Therapeutics PTGX and Catabasis Pharmaceuticals CATB. Whlle Ligand and Protagonist sport a Zacks Rank #1 (Strong Buy), Catabasis carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

Ligand’s earnings per share estimates have moved up $4.20 to $4.43 for 2018 over the last 30 days. The company delivered a positive earnings surprise in three of the trailing four quarters, with an average beat of 24.88%. The company’s shares have rallied 14.6% year to date.

Protagonist’s loss estimates narrowed from $1.68 to 66 cents for 2018 and from $2.43 to $1.26 for 2019, over the last 60 days. The company delivered a positive earnings surprise in three of the trailing four quarters, with an average beat of 24.95%.

Catabasis’ loss estimates narrowed from $1.09 to 90 cents for 2018 and from $1.76 to $1.43 for 2019, in the last 60 days. The company came up with a positive earnings surprise in all the preceding four quarters, with an average beat of 14.56%. The stock has rallied 7.4% so far this year.

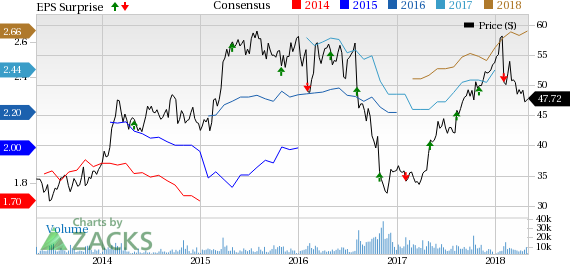

Novo Nordisk A/S Price, Consensus and EPS Surprise

Novo Nordisk A/S Price, Consensus and EPS Surprise | Novo Nordisk A/S Quote

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Catabasis Pharmaceuticals, Inc. (CATB) : Free Stock Analysis Report

Protagonist Therapeutics, Inc. (PTGX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research