Is There Now An Opportunity In Soligenix Inc (SNGX)?

Soligenix Inc (NASDAQ:SNGX), a biotechnology company based in United States, saw a decent share price growth in the teens level on the NasdaqCM over the last few months. As a small cap stock, which tends to lack high analyst coverage, there is generally more of an opportunity for mispricing as there is less activity to push the stock closer to fair value. Is there still an opportunity here to buy? Today I will analyse the most recent data on SNGX’s outlook and valuation to see if the opportunity still exists. View our latest analysis for Soligenix

What's the opportunity in SNGX?

The stock seems fairly valued at the moment according to my relative valuation model. In this instance, I’ve used the price-to-book (PB) ratio given that there is not enough information to reliably forecast the stock’s cash flows, and its earnings doesn’t seem to reflect its true value. I find that SNGX’s ratio of 3.6x is trading slightly below its industry peers’ ratio of 4.4x, which means if you buy SNGX today, you’d be paying a relatively reasonable price for it. And if you believe that SNGX should be trading at this level in the long run, then there’s not much of an upside to gain from mispricing. Although, there may be an opportunity to buy in the future. This is because SNGX’s beta (a measure of share price volatility) is high, meaning its price movements will be exaggerated relative to the rest of the market. If the market is bearish, SNGX’s shares will likely fall by more than the rest of the market, providing a prime buying opportunity.

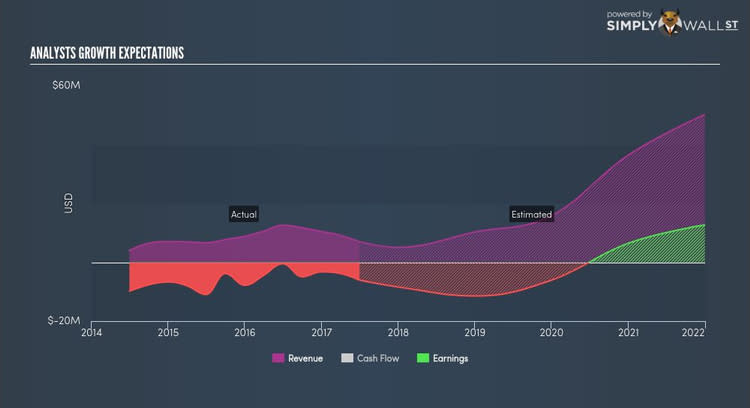

What kind of growth will SNGX generate?

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Buying a great company with a robust outlook at a cheap price is always a good investment, so let’s also take a look at SNGX future expectations. However, with an extremely negative double-digit change in profit expected over the next couple of years, near-term growth is certainly not a driver of a buy decision. It seems like high uncertainty is on the cards for SNGX, at least in the near future.

What this means for you:

Are you a shareholder? Currently, SNGX appears to be trading around its fair value, but given the uncertainty from negative returns in the future, this could be the right time to de-risk your portfolio. Is your current exposure to the stock optimal for your total portfolio? And is the opportunity cost of holding a negative-outlook stock too high? Before you make a decision on SNGX, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping an eye on SNGX for a while, now may not be the most advantageous time to buy, given it is trading around its fair value. The price seems to be trading at fair value, which means there’s less benefit from mispricing. Furthermore, the negative growth outlook increases the risk of holding the stock. However, there are also other important factors we haven’t considered today, which can help crystalize your views on SNGX should the price fluctuate below its true value.

Price is just the tip of the iceberg. Dig deeper into what truly matters – the fundamentals – before you make a decision on Soligenix. You can find everything you need to know about SNGX in the latest infographic research report. If you are no longer interested in Soligenix, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.