Is Now The Right Time To Invest In Financials And Stellar Acquisition III Inc (NASDAQ:STLR)?

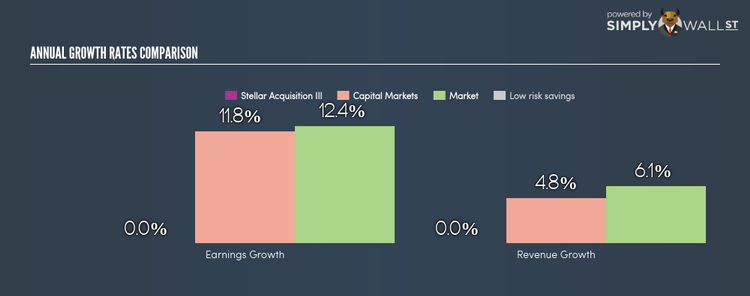

Stellar Acquisition III Inc (NASDAQ:STLR), a USD$28.34M small-cap, is a capital market firm operating in an industry, which now face the choice of either being disintermediated or proactively disrupting their own business models to thrive in the future. Financial services analysts are forecasting for the entire industry, a somewhat weaker growth of 7.95% in the upcoming year , and an overall negative growth rate in the next couple of years. Unsuprisingly, this is below the growth rate of the US stock market as a whole. Today, I will analyse the industry outlook, as well as evaluate whether Stellar Acquisition III is lagging or leading in the industry. Check out our latest analysis for Stellar Acquisition III

What’s the catalyst for Stellar Acquisition III’s sector growth?

The threat of disintermediation in the capital markets industry is both real and imminent, taking profits away from traditional incumbent financial institutions. In the past year, the industry delivered growth in the teens, beating the US market growth of 10.73%. Stellar Acquisition III lags the pack with its sustained negative earnings over the past couple of years. The company’s outlook seems uncertain, with a lack of analyst coverage, which doesn’t boost our confidence in the stock. This lack of growth and transparency means Stellar Acquisition III may be trading cheaper than its peers.

Is Stellar Acquisition III and the sector relatively cheap?

The capital markets industry is trading at a PE ratio of 17x, in-line with the US stock market PE of 20x. This means the industry, on average, is fairly valued compared to the wider market – minimal expected gains and losses from mispricing here. However, the industry returned a higher 12.81% compared to the market’s 10.46%, potentially illustrative of past tailwinds. Since Stellar Acquisition III’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge Stellar Acquisition III’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

Are you a shareholder? Capital markets stocks are currently expected to grow slower than the average stock on the index. This means if you’re overweight in this sector, your portfolio will be tilted towards lower-growth. If growth was one of your main investment catalyst in the sector, now would be the time to revisit your holdings in Stellar Acquisition III. Keep in mind the sector is trading relatively in-line with the rest of the market, which may mean you’ll be selling out at a reasonable price.

Are you a potential investor? The financial sector’s below-market growth and average valuation hardly makes it an exciting investment case. If you’re looking for a high-growth stock with potential mispricing, it seems like capital markets companies like Stellar Acquisition III isn’t the right place to look. However, if you’re interested in the stock for other reasons, I suggest you research more into the company’s cash flow as well as its financial health in order to gain a holistic view of the stock.

For a deeper dive into Stellar Acquisition III’s stock, take a look at the company’s latest free analysis report to find out more on its financial health and other fundamentals. Interested in other financial stocks instead? Use our free playform to see my list of over 600 other financial companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.