Is Now The Right Time To Invest In Tech And Sogou Inc (NYSE:SOGO)?

Sogou Inc (NYSE:SOGO), is a USD$5.06B mid-cap, which operates in the software industry based in China. Whether it’s the next big thing in tech or an alliance with a partner in another industry, tech companies have plenty of opportunities for their companies to thrive. Tech analysts are forecasting for the entire software tech industry, a relatively muted growth of 4.54% in the upcoming year . Today, I’ll take you through the tech sector growth expectations, as well as evaluate whether Sogou is lagging or leading in the industry. See our latest analysis for Sogou

What’s the catalyst for Sogou’s sector growth?

US-based mega-competitors have been, and continue to be, the key drivers of industry growth. Many tech companies are repositioning themselves by focusing on high-growth areas such as IBM’s artificial intelligence play in Watson and Adobe’s shift to marketing its product for cloud computing. Over the past year, the industry saw growth of 7.42%, though still underperforming the wider US stock market. Sogou leads the pack with its impressive earnings growth of over 100% last year. Furthermore, analysts are expecting this trend of above-industry growth to continue, with Sogou poised to deliver a triple digit growth over the next couple of years.

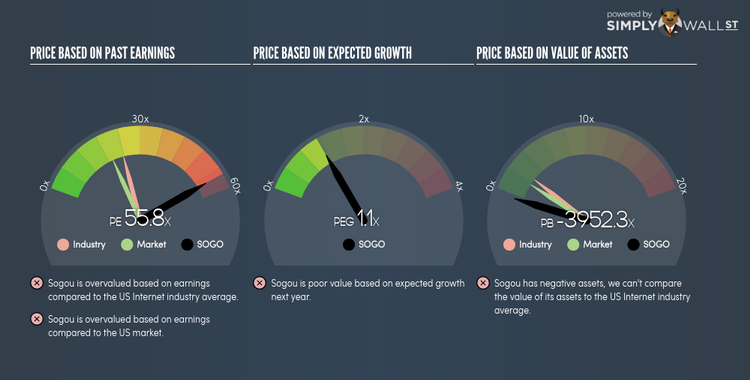

Is Sogou and the sector relatively cheap?

The software tech industry is trading at a PE ratio of 24x, relatively similar to the rest of the US stock market PE of 20x. This illustrates a fairly valued sector relative to the rest of the market, indicating low mispricing opportunities. Furthermore, the industry returned a similar 12.14% on equities compared to the market’s 10.45%. On the stock-level, Sogou is trading at a higher PE ratio of 56x, making it more expensive than the average tech stock. In terms of returns, Sogou generated 40.18% in the past year, which is 28.03% over the tech sector.

What this means for you:

Are you a shareholder? Sogou’s industry-beating future is a positive for shareholders, indicating they’ve backed a fast-growing horse. However, this higher growth prospect is also reflected in Sogou’s high price, suggested by its higher PE ratio relative to its peers. If you’re bullish on the stock and well-diversified by industry, you may decide to hold onto Sogou as part of your portfolio. However, if you’re relatively concentrated in tech, the Sogou’s high PE may signal the right time to sell.

Are you a potential investor? If Sogou has been on your watchlist for a while, now may not be the best time to enter into the stock since it is trading at a higher valuation compared to other tech companies. However, that being said, its industry-beating growth prospects may be the reason for high relative valuation. I suggest you look at Sogou’s future cash flows in order to assess whether the stock is trading at a reasonable price on this basis.

For a deeper dive into Sogou’s stock, take a look at the company’s latest free analysis report to find out more on its financial health and other fundamentals. Interested in other tech stocks instead? Use our free playform to see my list of over 1000 other tech companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.