Is Now The Time To Put Essential Properties Realty Trust (NYSE:EPRT) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like Essential Properties Realty Trust (NYSE:EPRT), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Essential Properties Realty Trust

Essential Properties Realty Trust's Improving Profits

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that Essential Properties Realty Trust grew its EPS from US$0.095 to US$0.52, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

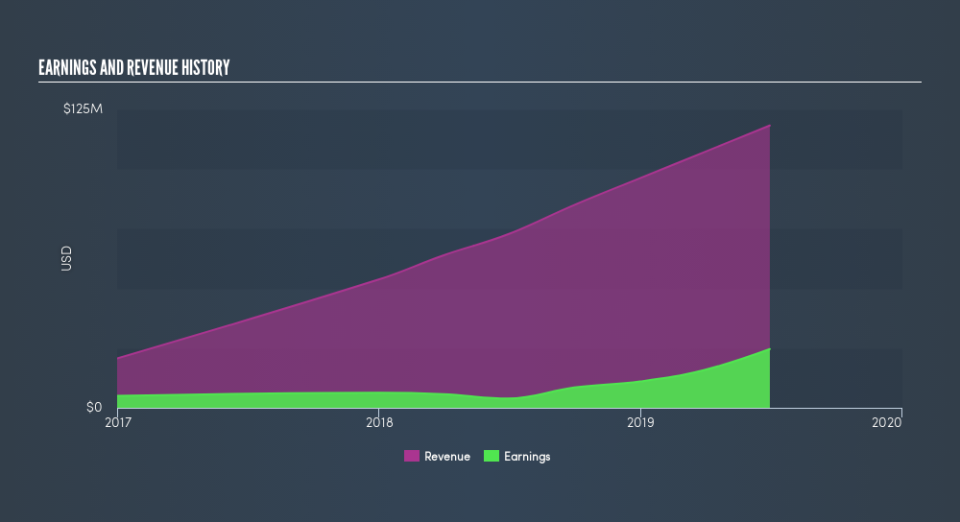

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Essential Properties Realty Trust shareholders can take confidence from the fact that EBIT margins are up from 48% to 53%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Essential Properties Realty Trust.

Are Essential Properties Realty Trust Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Essential Properties Realty Trust shares worth a considerable sum. To be specific, they have US$18m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Essential Properties Realty Trust Deserve A Spot On Your Watchlist?

Essential Properties Realty Trust's earnings per share have taken off like a rocket aimed right at the moon. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So to my mind Essential Properties Realty Trust is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Of course, just because Essential Properties Realty Trust is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Although Essential Properties Realty Trust certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.