NRG Energy (NRG) Q3 Earnings Beat Estimates, Revenues Fall Y/Y

NRG Energy, Inc.’s NRG third-quarter 2020 earnings of $1.02 per share from continuing operations beat the Zacks Consensus Estimate of $1.01 by 1%. Nevertheless, the bottom line declined 29.7% from the year-ago quarter’s figure.

Revenues

NRG Energy’s quarterly revenues logged $2,809 million, down 6.2% from the year-ago quarter’s figure.

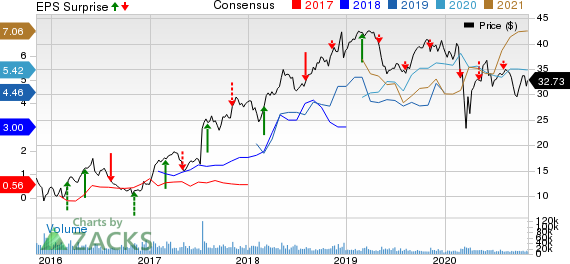

NRG Energy, Inc. Price, Consensus and EPS Surprise

NRG Energy, Inc. price-consensus-eps-surprise-chart | NRG Energy, Inc. Quote

Highlights of the Release

Third-quarter adjusted EBITDA was $752 million compared with $792 million in the year-ago quarter.

The company’s total operating costs and expenses in the quarter amounted to $2.42 billion, down 1.6% from $2.46 billion in the year-ago quarter. This upside is owing to lower cost of operations.

Operating income was $393 million, down 27.2% from $540 million in the year-ago quarter. Interest expenses of $99 million were on par with the prior-year quarter’s tally.

Financial Highlights

As of Sep 30, 2020, the company had cash and cash equivalents worth $697 million compared with $345 million as of Dec 31, 2019.

As of Sep 30, 2020, the company’s long-term debt amounted to $5,792 million compared with $5,803 million as of Dec 31, 2019.

The company’s net cash provided by operating activities in the first nine months of 2020 was $1,386 million compared with $897 million generated in the prior-year’s comparable period.

Capital expenditures in the first nine months of 2020 were $167 million compared with $183 million in the comparable period last year.

Guidance

The company narrowed 2020 adjusted EBITDA outlook to the range of $1,950-$2,050 million from the prior range of $1,900-$2,100 million. It updated its 2020 free cash flow before growth investments to the $1,450-$1,550 band from the previous range of $1,275-$1,475 million.

The company maintained 2021 adjusted EBITDA view in the range of $1,900-$2,100 million. It lowered its 2021 free cash flow before growth investments to the $1,200-$1,400 band from the previous range of $1,275-$1,475 million.

Zacks Rank

NRG Energy has a Zacks Rank #3 (Hold), currently. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

Pinnacle West Capital Corporation’s PNW adjusted earnings per share of $3.07 in the third quarter of 2020 beat the Zacks Consensus Estimate of $2.98 by 3%.

Xcel Energy Inc. XEL posted third-quarter 2020 operating earnings of $1.14 per share, surpassing the Zacks Consensus Estimate of $1.08 by 5.6%.

NiSource Inc NI delivered net operating earnings of 9 cents per share in third-quarter 2020, which surpassed the Zacks Consensus Estimate of 2 cents by 85.7%.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

NiSource, Inc (NI) : Free Stock Analysis Report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research