Nu Skin (NUS) Q4 Earnings Top Estimates, Sales Down Y/Y

Nu Skin Enterprises, Inc. NUS posted fourth-quarter 2022 results, with the top and the bottom line declining year over year. Revenues missed the Zacks Consensus Estimate while earnings surpassed the same.

The company is on track with its Nu Vision 2025 strategy. However, persistent macroeconomic challenges like COVID-related disruptions, unfavorable currency rates and global inflation are concerns. Management expects its global macro environment to remain challenging in the near term, reflected in its 2023 view.

In 2022, the company introduced its first connected device, ageLOC LumiSpa iO, further strengthening its position as the world’s leading beauty device system brand. The company also rolled out its Vera and Stela apps across all markets. Management is on track to advance EmpowerMe’s personalized beauty and wellness strategy with the introduction of the body iO smart, connected device system and rolling out the TRMe weight management line.

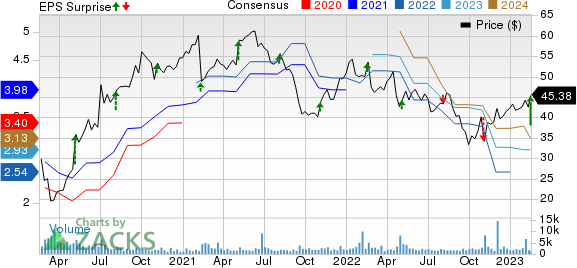

Nu Skin Enterprises, Inc. Price, Consensus and EPS Surprise

Nu Skin Enterprises, Inc. price-consensus-eps-surprise-chart | Nu Skin Enterprises, Inc. Quote

Q4 Highlights

Nu Skin’s fourth-quarter adjusted earnings of 89 cents a share declined from $1.11 reported in the year-ago quarter. Nevertheless, the metric surpassed the Zacks Consensus Estimate of 53 cents.

Revenues of $522.3 million fell 22% year over year on a reported basis. Revenues included a negative impact of 7% from foreign currency fluctuations. The top line lagged the Zacks Consensus Estimate of $543.8 million.

Sales leaders were down 21% year over year to 48,737. Nu Skin’s customer base dropped 16% to 1,147,124. The company’s paid affiliates were down 13% to 236,956.

Adjusted gross profit of $374.5 million declined from $506.3 million reported in the year-ago quarter. Gross margin, excluding restructuring impact, came in at 71.7%, down from 75.2% reported in the year-ago quarter. The downside was due to unfavorable currency rates, global inflationary pressures and geographic footprint. Nu Skin business’ gross margin came in at 74.9%, down from 77.9% reported in the year-ago quarter.

Selling expenses declined to $201 million from $263.3 million reported in the prior-year quarter. As a percentage of revenues, the metric was 38.5%, down from 39.1% reported in the year-ago quarter. Nu Skin business’ selling expenses were 40.5% compared with 41.4% in the prior-year quarter.

General and administrative expenses of $127.7 million declined from $164.2 million in the year-ago quarter. As a percentage of revenues, general and administrative expenses remained flat year over year at 24.4%.

Adjusted operating income of $45.8 million declined from $78.8 million in the year-ago quarter. The adjusted operating margin contracted to 8.8% from 11.7% reported in the year-ago quarter.

Segmental Results

Segment-wise, revenues (at cc) declined 7%, 37%, 8%, 26%, 9% and 10% in Americas, Mainland China, Southeast Asia/Pacific, South Korea, EMEA and Hong Kong/Taiwan, respectively. The same rose 6% in Japan. Total Nu Skin revenues fell 15% at cc from the prior-year quarter.

Image Source: Zacks Investment Research

Other Financial Details

Nu Skin ended the quarter with cash and cash equivalents of $264.7 million, long-term debt of $377.5 million, and total stockholders' equity of $897.3 million.

In the reported quarter, the company paid out dividends of $19 million and repurchased $10 million worth of shares. With this, it currently has $175.4 million remaining under the current share repurchase authorization. In a recent development, management announced a dividend hike to 39 cents per share. The increased dividend will be paid on Mar 8, 2023, to shareholders record as of Feb 27.

Guidance

Nu Skin anticipates revenues of $2.03-$2.18 billion for 2023, suggesting a 2-9% decline from the year-ago period’s reported figure. The company envisions an unfavorable foreign currency impact of 1-2% on 2023 revenues.

Management expects 2023 adjusted earnings of $2.35-$2.75 per share. The current projection suggests a decline from adjusted earnings of $2.90 reported last year.

For the first quarter, Nu Skin expects revenues between $450 million and $490 million, including an unfavorable foreign currency impact of 5-6%. The current revenue projection suggests a 19-26% decline from the year-ago quarter’s reported level. The company expects adjusted earnings of 25-35 cents a share for the first quarter.

The Zacks Rank #3 (Hold) company’s shares have increased 20% in the past three months compared with the industry’s 15.5% growth.

3 Top-Ranked Cosmetics Stocks

Here are some other top-ranked stocks, namely e.l.f. Beauty ELF, Helen of Troy HELE and Inter Parfums IPAR .

e.l.f. Beauty currently sports a Zacks Rank of 1 (Strong Buy). ELF has a trailing four-quarter earnings surprise of 105%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for e.l.f. Beauty’s current financial-year sales and earnings suggests growth of 39.1% and 61.9%, respectively, from the prior-year reported numbers.

Helen of Troy currently carries a Zacks Rank of 2 (Buy). HELE has a trailing four-quarter earnings surprise of 13.4%, on average. Helen of Troy has a long-term earnings growth rate of 8%.

The Zacks Consensus Estimate for HELE’s current financial-year sales and earnings suggests declines of almost 8% and 24.6%, respectively, from the prior year’s reported numbers.

Inter Parfums currently has a Zacks Rank #2 and an expected long-term earnings growth rate of 15%. IPAR has a trailing four-quarter earnings surprise of 27.8%, on average.

The Zacks Consensus Estimate for Inter Parfums’ current financial-year sales and earnings suggests growth of 23.6% and 29.5%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Helen of Troy Limited (HELE) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS) : Free Stock Analysis Report

e.l.f. Beauty (ELF) : Free Stock Analysis Report