Nucor (NUE) Raises Regular Quarterly Cash Dividend by 23%

Nucor Corporation NUE recently announced the hike in its regular quarterly cash dividend on its common stock to 50 cents per share, up 23% from the prior payout of 40.5 cents. This is Nucor’s 195th consecutive quarterly cash dividend, which is payable on Feb 11, 2022 to shareholders of record as of Dec 31, 2021.

Nucor raised its regular, or base, dividend for 49 consecutive years since it first started paying out dividends in 1973.

Nucor's board also approved the buyback of up to $4 billion of the company's outstanding common stock. This new authorization replaces the earlier-authorized $3 billion repurchase program, which was terminated by the Board in connection with the approval of the new authorization, under which roughly $2.33 billion of its company's common stock had been repurchased from its authorization in May 2021 through Dec 1, 2021.

The company forecasts share repurchases to be made from time to time in the open market at prevailing market prices or through private transactions or block trades. The timing and amount of buybacks will depend on market conditions, share price, applicable legal requirements and other factors. The new share buyback authorization is discretionary and has no expiration date.

Nucor returned roughly $3.53 billion to shareholders in the form of share repurchases and dividend payments year-to-date through Dec 1, 2021.

Nucor’s cash and cash equivalents fell roughly 38% year over year to $1,764.3 million at the end of the third quarter.

Shares of Nucor have gained 97.5% in the past year compared with a 30.5% surge of the industry.

Image Source: Zacks Investment Research

Nucor, in its last earnings call, stated that it sees continued strong results in the fourth quarter with earnings potentially exceeding the record-level set in the third quarter. The company expects strong demand across most end-use markets to continue into 2022.

Nucor expects improved profitability in the steel mills segment in the fourth quarter on a sequential comparison basis on additional earnings growth at its sheet and plate mills. The company also sees higher profitability in the steel products segment in the fourth quarter. However, earnings in the raw materials segment are forecast to decline sequentially in the fourth quarter due to margin compression at its direct reduced iron facilities.

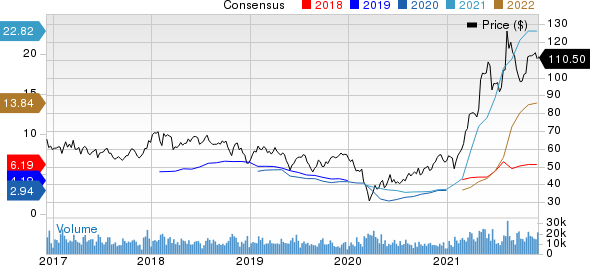

Nucor Corporation Price and Consensus

Nucor Corporation price-consensus-chart | Nucor Corporation Quote

Zacks Rank & Other Key Picks

Nucor currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Celanese Corporation CE, The Chemours Company CC and The Mosaic Company MOS.

Celanese has an expected earnings growth rate of 139.5% for the current year. The Zacks Consensus Estimate for current-year earnings has been revised 8.7% upward in the past 60 days.

Celanese beat the Zacks Consensus Estimate for earnings in each of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 12.7%, on average. The stock has surged around 18.2% in a year. CE currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Chemours has an expected earnings growth rate of 105.1% for the current year. The Zacks Consensus Estimate for the current year has been revised 10% upward in the past 60 days.

Chemours beat the Zacks Consensus Estimate for earnings in all of the last four quarters. The company has a trailing four-quarter earnings surprise of roughly 34.2%, on average. CC has increased around 11.1% over a year. CC currently sports a Zacks Rank #2.

Mosaic has a projected earnings growth rate of 500% for the current year. The consensus estimate for the current year has been revised 0.8% upward in the past 60 days.

Mosaic beat the Zacks Consensus Estimate for earnings in three of the last four quarters. MOS has a trailing four-quarter earnings surprise of 38.1%, on average. The company’s shares have gained around 56% in a year. It currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Celanese Corporation (CE) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

The Chemours Company (CC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research