Nutanix's (NTNX) Q3 Loss Narrower Than Expected, Revenues Beat

Nutanix NTNX incurred third-quarter fiscal 2021 adjusted loss of 41 cents per share, significantly narrower than the Zacks Consensus Estimate loss of 47 cents per share. Moreover, the figure is narrower than the year-ago quarter’s adjusted loss of $1.22.

Revenues increased 8% year over year to $344.5 million and surpassed the consensus mark $336.6 million. However, the company noted that the ongoing transition to a subscription-based business model led to a decline in the average contract term to 3.3 years from 3.4 years in second-quarter fiscal 2021. This, in turn, adversely impacted the top-line performance.

Top-Line Details

Product revenues (50% of revenues) fell 4.7% year over year to $172.3 million. Support, entitlements & other services revenues (50% of revenues) grew 25.2% to $172.2 million.

Subscription revenues (89.2% of revenues) rose 17.8% from the year-ago quarter to $307.3 million. Professional services revenues (5.6% of revenues) jumped 67.7% to $19.5 million.

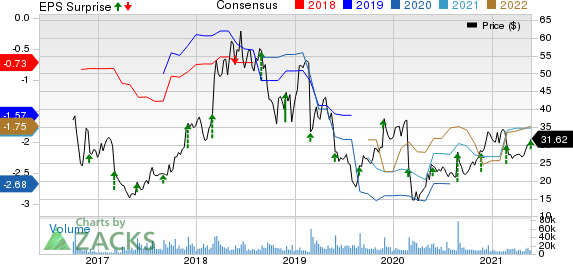

Nutanix Inc. Price, Consensus and EPS Surprise

Nutanix Inc. price-consensus-eps-surprise-chart | Nutanix Inc. Quote

The top line was primarily driven by growth in the company’s core hyper-converged infrastructure software and the solid adoption of its new capabilities. The company also benefited from the strong adoption of its hybrid cloud solution on Amazon’s AMZN cloud platform, Amazon Web Services (AWS).

Non-Portable Software revenues (4.9% of revenues) plunged 60% year over year to $16.7 million. Moreover, hardware revenues (0.3% of revenues) plummeted 74.2% to $0.98 million.

Billings were down 3.2% year over year to $371.1 million. However, Annual Contract Value (ACV) billings were $159.9 million, up 18% year over year. Moreover, Nutanix’s run-rate ACV grew 25% year on year to $1.45 billion.

During the fiscal third quarter, the company added 660 customers, bringing the total number of clients to 19,430.

Apart from the U.S. Air Force, the company added some notable Global 2000 customers, including India-based ICICI Bank Limited, Alimentation Couche-Tard (operator of the Circle K brand), NTT Communications Corporation, and Sony Device Technology (Thailand) Co., Ltd.

Apart from this, the company’s partnership with Microsoft MSFT, to deliver hybrid cloud solutions and unified management across on-premises and Azure environments, is a positive.

Operating Details

During the fiscal third quarter, Nutanix’s non-GAAP gross margin expanded 100 basis points (bps) year over year to 81.7%.

Operating expenses declined 7.4% year over year to $361.5 million.

Balance Sheet & Cash Flow

As of Apr 30, 2021, cash and cash equivalents plus short-term investments were $1.25 billion, down slightly from $1.29 billion at the end of second-quarter fiscal 2021.

Cash used in operating activities was $55.6 million, significantly lower than $84.9 million in seen the year-ago quarter. Free cash outflow was $71.5 million compared with the prior quarter’s $117.5 million.

During the first nine months of fiscal 2021, the company used $75.2 million cash in operational activities and has a free cash outflow of $116.3 million.

Guidance

For fourth-quarter fiscal 2021, ACV billings are projected between $170 million and $175 million. Non-GAAP gross margin is estimated to be in the range of 81.5% to 82%. Further, non-GAAP operating expenses are expected between $380 million and $385 million.

Zacks Rank & Stock to Consider

Nutanix currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the broader technology sector is Lam Research Corporation LRCX, which sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Lam Research is pegged at 32.8%.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency have sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Nutanix Inc. (NTNX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research