NVIDIA Soars in AI Market With New Platform & Partnerships

NVIDIA Corporation’s NVDA efforts in artificial intelligence (AI) and machine learning in various fields are gathering momentum, thanks to its initiatives and adoption of its technologies by key companies.

The past week has been quite eventful for NVIDIA. Swedish automaker Volvo Cars chose NVIDIA’s DRIVE AGX Xavier platform, an advanced car computer, to be incorporated in its next-generation automated cars.

Moreover, Oracle ORCL chose to support NVIDIA HGX-2 platform on its Cloud Infrastructure to address growing demand for AI and machine learning across various industries.

However, major highlight of the week is the launch of open-source GPU-acceleration platform, RAPIDS, which is designed to enable companies to analyze a huge amount of data at unparalleled speed and make business decisions efficiently. This technology aims to accelerate data science pipelines significantly by transferring workflows onto graphics processing units (GPUs), optimizing machine learning training.

Notably, Oracle also announced that RAPIDS will be available on Oracle Cloud Infrastructure this week.

NVIDIA’s Efforts Paying Off

Advancements in AI and high performance computing (HPC) involve immense complexity and demand robust computing power. NVIDIA’s powerful technologies are designed to cater to these needs, driving major companies to select NVIDIA as their technology partner for ambitious projects.

Growing traction of AI among industries — including transportation, energy, manufacturing, smart cities, and healthcare — is benefiting NVIDIA.The company’s AI inference solution is helping it expand its total addressable market.

NVIDIA’s foray into autonomous vehicles and other automotive electronics space has been driving its stock since mid-2015. The company launched powerful AI supercomputer chips and partnered with premium carmakers, which are aiding its Automotive revenues.

With sustained focus on developing new and more advanced AI technologies for self-driving cars, we believe that the company is well poised to grow in the driverless vehicle technology space.

Moreover, NVIDIA’s focus on GRID platforms is increasing GPU adoption in data centers, giving it an advantage over its competitors. We believe that NVIDIA’s GRID enterprise virtual graphics, which improve visual effects of games, will aid its revenue and margin growth.

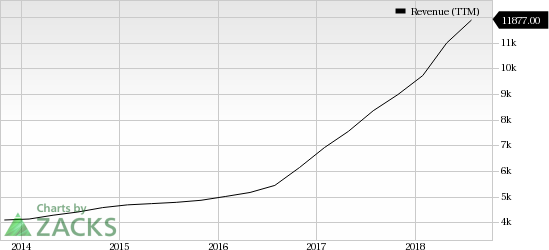

NVIDIA Corporation Revenue (TTM)

NVIDIA Corporation Revenue (TTM) | NVIDIA Corporation Quote

Competition Intensifies

AI-enabled chip-making has attractive prospects. Per IDC, global spending on AI Systems is expected to reach $77.6 billion in 2022. This also means that competition among major chipmakers will strengthen, with advancements in AI and machine learning.

Recently, in a bid to get out of the dependence on large semiconductor manufacturers, Huawei Technologies launched two AI chips, serving datacenters and smart devices.

Also, beside its partnership with NVIDIA, IBM tied up with more than 100 companies — including Google — through its OpenPower project, with intention of building an ecosystem around its Power chips. IBM’s chip architecture already supports big data and HPC workloads.

NVIDIA is already facing major competition from Advanced Micro Devices AMD in graphic chip-making for the PC market after Intel INTC, another major competitor, partnered with AMD for an 8th gen chip.

Nonetheless, continuous product launches in the computing segment and increasing demand for NVIDIA’s graphics chips and technologies are positives for the company, which are likely to help it maintain its stronghold in the intensely competitive AI-driven chip market.

NVIDIA currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Intel Corporation (INTC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research