NVR Q1 Earnings Surpass Estimates, Backlogs Rise 42% Y/Y

NVR, Inc. NVR reported better-than-expected results for first-quarter 2021. Earnings not only beat estimates for the third straight quarter but also improved significantly year over year. Results benefited from robust demand for new homes on lower mortgage rates and a rising work-from-home trend in the United States.

Despite the solid results, shares of the company fell 2.2% during trading hours on Apr 21. Notably, negative investor sentiments were witnessed as the company reported lower earnings compared with the previous quarter.

Earnings & Revenue Discussion

The company reported earnings of $63.21 per share, which topped the consensus mark of $61.90 by 2.1%. Also, the reported figure grew 40.6% from the prior-year figure of $44.96 per share.

Total revenues (Homebuilding & Mortgage Banking fees combined) amounted to $2.04 billion for the reported quarter. The figure increased 29% on a year-over-year basis, backed by robust demand for new homes on lower mortgage rates.

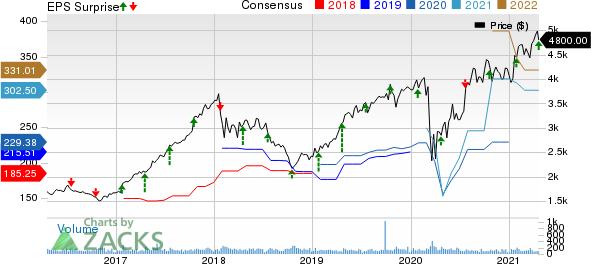

NVR, Inc. Price, Consensus and EPS Surprise

NVR, Inc. price-consensus-eps-surprise-chart | NVR, Inc. Quote

Segment Details

Homebuilding: Revenues at the segment totaled $1.96 billion, up 26.2% from the year-ago level. However, the metric missed the consensus estimate of $2.1 billion by 4.4%. Settlements were up 20% year over year to 5,072 units.

Notably, new orders increased a notable 26% from the prior year to 6,314 units. Average sales price of new orders also inched up 10% from the prior-year quarter to $410,500. Cancellation rate was 10% for the quarter, down from 21% in the year-ago period.

Quarter-end backlog — on a unit and dollar basis — was up 42% and 51% from the year-ago quarter to 12,791 units and $5.20 billion, respectively.

Gross margin came increased 19.7% year over year.

Mortgage Banking: Mortgage banking fees increased 189.8% year over year to $77.7 million. Moreover, mortgage closed loan production totaled $1.41 billion, up 25% year over year.

Financials

At first-quarter end, NVR had cash and cash equivalents for Homebuilding and Mortgage Banking of $2.75 billion and $21.1 million compared with $2.71 billion and $63.55 million, respectively, at 2020-end.

Zacks Rank & Peer Releases

NVR — which share space with Toll Brothers, Inc. TOL, KB Home KBH and Lennar Corporation LEN in the same industry — currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Toll Brothers reported first-quarter fiscal 2021 (ended Jan 31, 2021) results, wherein earnings and revenues topped the Zacks Consensus Estimate on solid housing gross margin.

KB Home — currently carrying a Zacks Rank #1 — posted impressive first-quarter fiscal 2021 results. The results are mainly attributable to a favorable pricing environment due to robust housing market demand, increased operating leverage on higher revenues and lower amortization of previously capitalized interest.

Lennar Corporation — currently carrying a Zacks Rank #2 (Buy) — reported better-than-expected results for first-quarter fiscal 2021 (ended Feb 28, 2021). The quarterly results benefited from robust housing market fundamentals backed by low interest rates. Also, solid execution of homebuilding and financial services businesses added to the positives.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research