NY-Based Schulte Roth Touts Solid Year in 2018 as It Pivots to Younger Leaders

Photo: Diego M. Radzinschi/ALM

Schulte Roth & Zabel turned in "a solid year" in 2018, executive committee chairman Alan Waldenberg said, as it pivots toward a younger generation of lawyers and leaders.

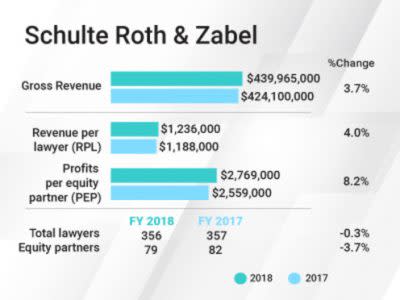

The New York-based firm saw gross revenue increase by 3.7 percent in 2018, to $429.97 million, as revenue per lawyer (RPL) increased by 4 percent, reaching $1.24 million.

Profits per equity partner (PEP) jumped 8.2 percent to $2.77 million in 2018, split across a slightly smaller partner tier of 79 lawyers. The firm has no nonequity tier.

Still, net income was up by 4.3 percent, at $218.75 million for the firm, which boasted a 50 percent profit margin in 2018, up one percentage point from 2017.

The firm did not take any unusual cost-cutting measures in 2018, Waldenberg said. And rates increased consistent with the rest of the market. With regard to the profit margin growth, he said, "some other people are really good at running the business."

Waldenberg credited strength in practices "across the board" for the firm's 2018 performance. The M&A, litigation and shareholder activism practices were especially active, he said, highlighting several matters.

A major deal the firm worked on was Veritas Capital's $1.05 billion acquisition of a large health care unit from GE. Schulte Roth also represented Albertsons in its attempt to merge with Rite Aid, though the deal ultimately failed.

In its activist practice, which Waldenberg called "the premiere practice in the city," the firm continued to work with activist campaigns related to Procter & Gamble and pizza company Papa John's.

In litigation, the firm represented Paragon Coin, a cryptocurrency startup aimed at the cannabis industry, in Securities and Exchange Commission matters, which settled in November. It is also representing former Equifax executive Jun Ying in an insider trading case. He was indicted last year, and pleaded guilty to securities fraud earlier this month.

Schulte Roth also saw a pickup in funds work related to cryptocurrentcy and blockchain, Waldenberg noted.

Investments in the Future

One area where Schulte Roth saw costs grow was associate pay. The firm matched market leaders, "to the dollar," which took starting salaries for first-years to $190,000. But he noted that the bonus structure is not identical to other firms, as "someone who works really hard here will make more."

"We’re lemmings," Waldenberg joked, with regard to associate salaries. He said that expense came out of partners' pockets.

"As salaries go up for associates, we have to be sure we can pay them," he said. "If they’re efficient, it’s not that expensive to pay for it."

Waldenberg also highlighted the firm's performance on The American Lawyer's Midlevel Associate Satisfaction Survey in 2018—Schulte Roth was the top-ranked firm based on associate responses, a vast improvement from its 78th-place finish two years before.

"That bodes well for associate retention and recruiting," he said.

As a whole, Schulte Roth is moving toward getting younger, Waldenberg said. The smaller equity partner tier was the result of a few older partners transitioning to of counsel status, he noted.

As that kind of change continues, the firm will likely have news around this time next year about a leadership transition at the top, Waldenberg said. And already this year, he said, the eight-person executive committee added two new members, in "an attempt to make it a little younger and change the membership a bit."

"We’ve been having discussion about this for a long time. It will be a perfectly natural kind of transition," Waldenberg said.