NY Times (NYT) Q2 Earnings Top Estimates, Subscriptions Rise

The New York Times Company NYT reported fourth straight quarter of earnings beat in second-quarter 2020. Total revenues also surpassed the Zacks Consensus Estimate, following a miss in the preceding five quarters. While the top line declined, the bottom line improved year over year owing to reduced adjusted operating costs and lower effective tax rate.

Notably, the company registered higher digital-only subscriptions during the quarter under review. However, we note that both print and digital advertising revenues showcased a decline from the year-ago period. Looking into the third quarter, management anticipates a sharp fall in advertising revenues owing to the coronavirus pandemic.

We note that this Zacks Rank #3 (Hold) stock has gained 35% compared with the industry’s rally of 33.5% in the past three months.

Let’s Delve Deeper

The New York Times Company delivered adjusted earnings from continuing operations of 18 cents a share that beat the Zacks Consensus Estimate of 5 cents and rose 5.9% from the year-ago period. The newspaper publisher's total revenues of $403.8 million outpaced the Zacks Consensus Estimate of $388.5 million but declined 7.5% year over year.

Subscription revenues improved 8.4% to $293.2 million primarily due to increase in the number of subscriptions to the company’s digital-only products, which include news product, and Cooking, Crossword and audio products. Revenues from digital-only products jumped 29.6% to $146 million.

Management now projects third-quarter 2020 total subscription revenues to increase about 10%, while digital-only subscription revenues are projected to surge approximately 30%.

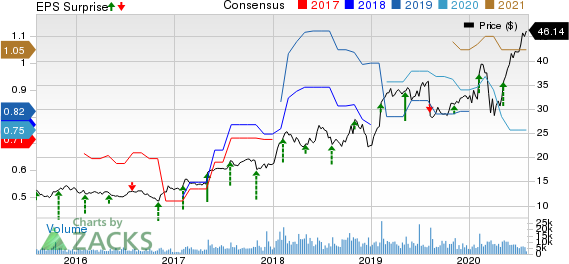

The New York Times Company Price, Consensus and EPS Surprise

The New York Times Company price-consensus-eps-surprise-chart | The New York Times Company Quote

Total advertising revenues were $67.8 million in the reported quarter, down 43.9% year over year. In the preceding quarter, total advertising revenues had slumped 15.2%. Total advertising revenues in the third quarter are estimated to decline approximately 35-40%.

Print advertising revenues fell 55% to $28.2 million in the quarter under review, following a decline of 20.9% in the preceding quarter. The metric declined as the ongoing pandemic further accelerated secular trends, largely impacting the entertainment, luxury and technology categories.

Digital advertising revenues decreased 31.9% to $39.5 million, following a decline of 7.9% in the preceding quarter. The fall in digital advertising revenues was due to reduced demand for direct-sold advertising on account of the coronavirus-induced crisis. Management expects digital advertising revenues to decrease roughly 20% in the third quarter, thanks to the ongoing pandemic.

We note that other revenues declined 5% to $42.8 million during the quarter under review primarily due to the conclusion of the first season of The Weekly television series and fall in revenues from live events and commercial printing. These were partly mitigated by increased revenues from licensing revenues related to Facebook News and affiliate referrals from Wirecutter. Management anticipates other revenues to decline approximately 10% in the third quarter.

Adjusted operating costs fell 7.6% to $351.6 million during the quarter. Management anticipates adjusted operating costs to be flat or down in the low-single digits in the third quarter. The company is deferring non-essential spending but intends to sustain investment into growing digital subscription business. Total adjusted operating profit fell 6.2% to $52.1 million during the quarter under review.

Other Financial Aspects

The New York Times Company ended the quarter with cash and marketable securities of about $756.7 million. The company has a $250 million revolving line of credit through 2024. As of Jun 28, 2020, there were no outstanding borrowings under the credit facility, and neither the company had other outstanding debt obligations. It incurred capital expenditures of about $5 million during the quarter. Management envisions capital expenditures of about $45 million in 2020.

Wrapping Up

The New York Times Company has come a long way from being a sole provider of news content and advertising on print publications. The company is no longer restricted to print. As readers swarmed to the Internet, advertisers followed suit and so did newspaper companies. Trimmed print operations paved way for online publications that led to the development of paywalls, as adopted by the company.

The company notified that the number of paid digital-only subscribers reached roughly 5,670,000 at the end of second-quarter 2020 – rising 669,000 sequentially and 1,890,000 year over year. Of the 669,000 total net additions, 493,000 came from the digital news product, while remaining came from Cooking, Crossword and audio products.

Key Picks

Shopify Inc. SHOP, which sports a Zacks Rank #1 (Strong Buy), has a long-term earnings growth rate of 32.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shaw Communications Inc. SJR, which carries a Zacks Rank #2 (Buy), has a long-term earnings growth rate of 3.5%.

TEGNA Inc. TGNA has a long-term earnings growth rate of 10%. The stock carries a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The New York Times Company (NYT) : Free Stock Analysis Report

Shaw Communications Inc. (SJR) : Free Stock Analysis Report

TEGNA Inc. (TGNA) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.