NYSE Tech Industry: A Deep Dive Into Aquantia Corp (NYSE:AQ)

Aquantia Corp (NYSE:AQ), is a US$457.79M small-cap, which operates in the tech hardware industry based in United States. Technology has become a vital component of every industry, bringing unprecedented opportunities for growth, along with challenges and competition. Tech analysts are forecasting for the entire hardware tech industry, a strong double-digit growth of 15.81% in the upcoming year , and an overall negative growth rate in the next couple of years. Unsuprisingly, this is below the growth rate of the US stock market as a whole. Today, I’ll take you through the tech sector growth expectations, as well as evaluate whether Aquantia is lagging or leading in the industry. See our latest analysis for Aquantia

What’s the catalyst for Aquantia’s sector growth?

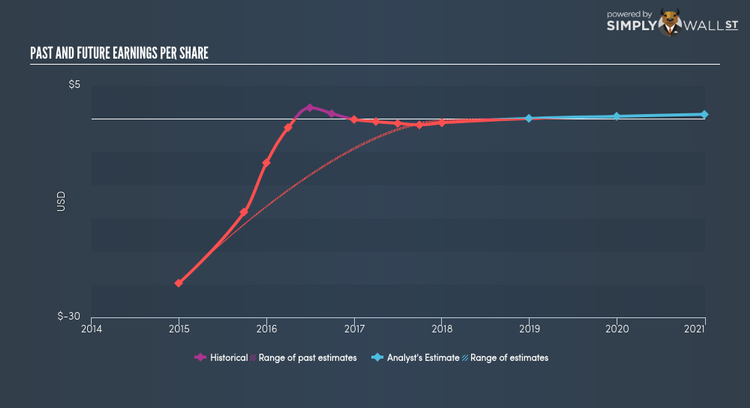

US-based mega-competitors have been, and continue to be, the key drivers of industry growth. Many tech companies are repositioning themselves by focusing on high-growth areas such as IBM’s artificial intelligence play in Watson and Adobe’s shift to marketing its product for cloud computing. Over the past year, the industry saw growth in the thirties, beating the US market growth of 9.74%. Aquantia lags the pack with its earnings falling by more than half over the past year, which indicates the company will be growing at a slower pace than its tech hardware peers. As the company trails the rest of the industry in terms of growth, Aquantia may also be a cheaper stock relative to its peers.

Is Aquantia and the sector relatively cheap?

The tech hardware sector’s PE is currently hovering around 23.57x, relatively similar to the rest of the US stock market PE of 18.79x. This means the industry, on average, is fairly valued compared to the wider market – minimal expected gains and losses from mispricing here. Furthermore, the industry returned a similar 11.56% on equities compared to the market’s 10.48%. Since Aquantia’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge Aquantia’s value is to assume the stock should be relatively in-line with its industry.

Next Steps:

Aquantia has been an tech industry laggard in the past year. If Aquantia has been on your watchlist for a while, now may be a good time to dig deeper into the stock. Although it delivered lower growth relative to its tech peers in the near term, the market may be pessimistic on the stock, leading to a potential undervaluation. However, before you make a decision on the stock, I suggest you look at Aquantia’s fundamentals in order to build a holistic investment thesis.

1. Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

2. Historical Track Record: What has AQ’s performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

3. Other High-Growth Alternatives : Are there other high-growth stocks you could be holding instead of Aquantia? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.