NYSE Top Cyclical Dividend Paying Stocks

The performance of consumer cyclical companies is heavily dependent on the economic cycle. Businesses that fall into this category range from consumer electronics to gambling, which tend to be considered as luxury items rather than necessities. This means, during times of an economic boom, consumers have a bit more income to splurge on a new TV, which increases the profitability of these businesses. Dividend payouts are, in turn, positively impacted by this growth which means these companies could provide opportune income through dividends. As a long term investor, I favour these consumer cyclical stocks with great dividend payments that continues to add value to my portfolio.

Guess’, Inc. (NYSE:GES)

GES has a substantial dividend yield of 5.74% and a reasonably sustainable dividend payout ratio , with an expected payout of 70.51% in three years. GES’s dividends have seen an increase over the past 10 years, with payments increasing from $0.32 to $0.9 in that time. They have been dependable too, not missing a single payment in this time. With a debt to equity ratio of 4.33%, GES appears to have solid financial health as well. More detail on Guess’ here.

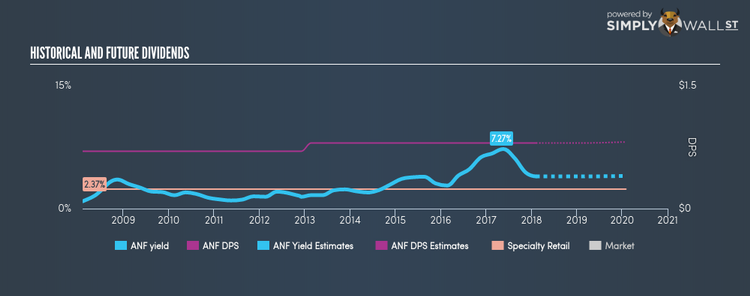

Abercrombie & Fitch Co. (NYSE:ANF)

ANF has a good-sized dividend yield of 3.93% and a reasonably sustainable dividend payout ratio , with analysts expecting a 134.73% payout in the next three years. The company’s DPS have increased from $0.7 to $0.8 over the last 10 years. The company has been a reliable payer too, not missing a payment during this time. ANF appears to be in good financial shape too, with a debt to equity ratio of 26.66%. Dig deeper into Abercrombie & Fitch here.

DSW Inc. (NYSE:DSW)

DSW has a great dividend yield of 4.15% and pays 74.48% of it’s earnings as dividends . Besides capital gain prospects, just the yield is higher than the low risk savings rate – enticing for investors with goals of beating their bank accounts. Plus, a 4.15% yield places it amidst the market’s top dividend payers. If analysts predictions are right, DSW has some strong earnings growth on the short-term horizon with an expected increase in EPS of 35.82% over the next 12 months. Interested in DSW? Find out more here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.