A. O. Smith (AOS) Q4 Earnings & Revenues Surpass Estimates

A. O. Smith Corporation AOS has reported better-than-expected fourth-quarter 2020 results, wherein both earnings and revenues beat estimates.

The company’s adjusted earnings were 74 cents per share, beating the Zacks Consensus Estimate of 59 cents. Also, the bottom line increased 32.1% from the year-ago figure of 56 cents.

In 2020, the company’s adjusted earnings came in at $2.16, down 5% year over year.

Top-Line Details

The company’s fourth-quarter net sales increased 11.1% year over year to $834.5 million. The increase was driven by higher sales in North America and China. Notably, the top line beat the Zacks Consensus Estimate of $763 million.

In 2020, the company’s net sales were $2,895.3 million, down 3.3% on a year-over-year basis.

A.O. Smith’s quarterly sales in North America (comprising the U.S. and Canada water heaters and boilers) moved up 7.2% year over year to $560.9 million. The segment’s results were driven by higher sales of residential water heaters.

Segmental operating earnings were up about 7% to $137.9 million on a year-over-year basis. The increase was on account of higher sales volume of residential water heaters and lower steel costs, partially offset by higher logistics costs.

Quarterly sales in Rest of World (including China, India and Europe) grew 19.1% year over year to $279 million. The increase was primarily backed by higher consumer demand for water treatment products and a favourable mix between product categories.

Operating earnings at the segment was $31.3 million compared with $1.5 million recorded in the year-ago quarter. Higher sales volume and lower operating costs were beneficial to the segment’s income.

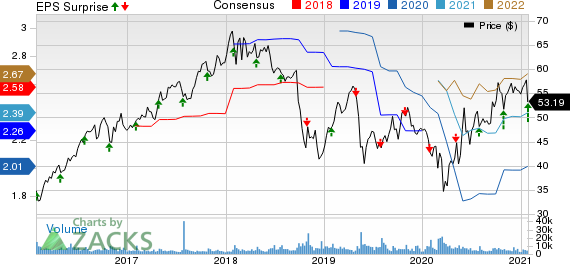

A. O. Smith Corporation Price, Consensus and EPS Surprise

A. O. Smith Corporation price-consensus-eps-surprise-chart | A. O. Smith Corporation Quote

Liquidity & Cash Flow

On Dec 31, 2020, A.O. Smith’s cash and cash equivalents totaled $573.1 million compared with $374 million as of Dec 31, 2019.

At the end of the reported quarter, long-term debt was $106.4 million compared with $277.2 million as of Dec 31, 2019.

In 2020, cash provided by the operating activities totaled $562.1 million compared with $456.2 million in the year-ago.

Share Repurchases

In 2020, the company repurchased shares worth $56.7 million, compared with $287.7 million worth of shares repurchased in 2019. It paid dividends worth $158.7 million compared with $149.2 million in the previous year.

Guidance

The company provided earnings guidance for 2021. It expects adjusted earnings of $2.40-$2.50. The mid-point reflects a year-over-year increase of 13.4%.

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Industrial Products sector are AGCO Corporation AGCO, AptarGroup, Inc. ATR and Dover Corporation DOV. While AGCO currently sports a Zacks Rank #1 (Strong Buy), AptarGroup and Dover carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO delivered a positive earnings surprise of 434.48%, on average, in the trailing four quarters.

AptarGroup delivered a positive earnings surprise of 10.91%, on average, in the trailing four quarters.

Dover delivered a positive earnings surprise of 18.1%, on average, in the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AGCO Corporation (AGCO) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Dover Corporation (DOV) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research