Oakmark Funds Commentary: The Case for European Financials

The outlook for the European banks owned in the Oakmark International Fund has moderated given the impact of the coronavirus to the global economy. While we are not experts at the coronavirus, we have a deep investment team who is experienced and practiced at valuing businesses. This disciplined approach helps us identify opportunities during times of crisis and increased volatility. We continue to believe we are positioned in the strongest banks in the sector, including BNP Paribas (XPAR:BNP), Credit Suisse Group (NYSE:CS), Intesa Sanpaolo (MIL:ISP), Lloyds Banking Group (NYSE:LYG) and Royal Bank of Scotland (NYSE:RBS), given they are well capitalized with high profitability buffers.

Impact to intrinsic value

We are constantly stress testing our assumptions to determine the interest rate and economic sensitivity of our banks. To incorporate slower economic growth and reduced central bank interest rates, we are making three key adjustments:

Reducing base interest rates

Lowering loan growth

Increasing credit costs

Interest rates

We believe the coronavirus will impact interim cash flows as governments take austerity measures and expect the lower base rates to persist for FY 2020 and for the first half of FY 2021. Our base case scenario is that rates remain lower for the next two years with an eventual return to pre-coronavirus normalcy in 2022. As a result of lower interest rates for potentially the next two years, we have brought down fair values by a few percentage points. In a lower for longer scenario, where these recently lowered rates persist for the next five years, our intrinsic value estimates would be reduced by mid-single digits.

European banks have been operating in an environment with negative interest rates for some time now. Actions taken by our banks have produced positive returns as a result of adeptly reducing costs, investing in digital and repositioning their asset mix toward superior quality. For example, we've invested with CEO Antonio Horta-Osorio since his days at Banco Santander. We initiated a position in Lloyds, the U.K. leader in consumer banking, in December 2011 after his arrival because of Horta-Osorio's strong operational and capital allocation track record. Under his leadership, Lloyds has improved their net interest margin to 3%, twice the level of the average European bank.

If interest rates were to remain flat from the recently reduced levels over the next five years, our interim profitability and capital generation assumptions would need to be reduced and we estimate that this could be a 2-9% headwind to our projected fair values. Keep in mind that assumes no offsetting measures taken by management, including cost reduction measures, growing fee-based businesses and a rationalization of marginal competitors, a scenario we see as unlikely.

Asset quality

We do not see a big asset quality issue at the European banks. Given tighter underwriting standards, uncertainty surrounding Brexit and slow European growth heading into this disruption, we do not have residential or commercial real estate bubbles that need correcting, unlike heading into the global financial crisis. Governments across Europe are being very proactive in supporting small- and medium-sized enterprises and industries that are more exposed to the coronavirus, such as airlines and hotels.

Going forward, we do assume increases in non-performing loans (NPLs) and bankruptcies of corporate clients of the European banks. Overall, we are modeling an increase in NPLs of 20% in FY2020 and 10% in FY2021 but we note that increases are on a very low base (i.e., RBS's NPL is at only 1.2%). Because we believe our bank holdings have strong loan books and good exposure to mortgages (which will be supported by governments), we do not believe these short-term adjustments will be material to our valuations.

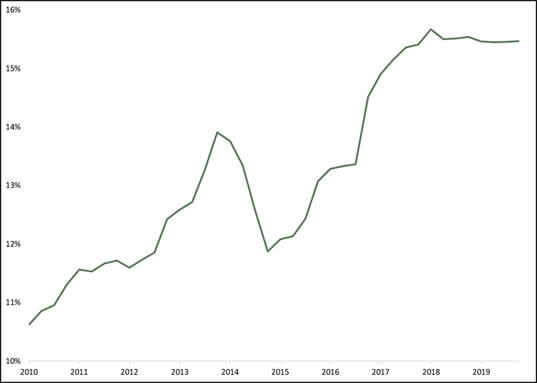

Figure 1: European Banks NPL Ratio

Source: Harris Associates

Credit costs

As is typical when an economic cycle ends, we are now modeling in an increase in the cost of credit over the next two years.

Figure 2: Credit cost scenario analysis

Oakmark International Holding | FY 2020 Credit Cost Increase | FY 2021 Credit Cost Increase |

|---|---|---|

BNP Paribas | 35% | 22% |

RBS | 27% | 10% |

Lloyds | 20% | 10% |

Intesa Sanpaolo | 45% | 30% |

Source: Harris Associates estimates. Credit cost changes versus our previous expectations. Oakmark International Fund holding Credit Suisse excluded from this chart as the primary impact to a private bank from COVID-19 is net new money (NNM), assets under management (AUM), and margins.

Importantly, we believe European banks remain better positioned now than during the global financial crisis in the context of materially higher liquidity buffers and higher capital.

Liquidity

The European Central Bank (ECB) is taking steps to ensure liquidity. The ECB reintroduced LTRO, a cheap loan scheme that was first used in 2011, with the aim to eliminate potential Euro liquidity strains. In the first LTRO auction this week, EUR109 billion was taken up by 110 banks. We believe this will be an effective back-stop for banks as funding conditions worsen. We are monitoring three month Libor - OIS spreads. While they have widened in the past week, they remain well off the global financial crisis highs.

Figure 3: 3 Month USD LIBOR -OIS Spread

Source: Harris Associates

Capital

When banks entered the global financial crisis, they were unprepared for the situation as their capital positions were roughly 6-7% as measured by the Core Tier 1 Capital Ratio (CET1). Today, they have doubled this amount of capital to levels around 12-14% from both capital increases and deleveraging. Not only is capital higher but it is on a higher risk weighted asset base as the risk weighting has increased since 2007.

While regulations and rules stiffened over the last decade, central banks in Europe and the United Kingdom are now reducing these counter cyclical buffers to help support the economy. The Bank of England (BOE) recently announced reduced capital requirements for both RBS and Lloyds, leaving them both way over-capitalized.

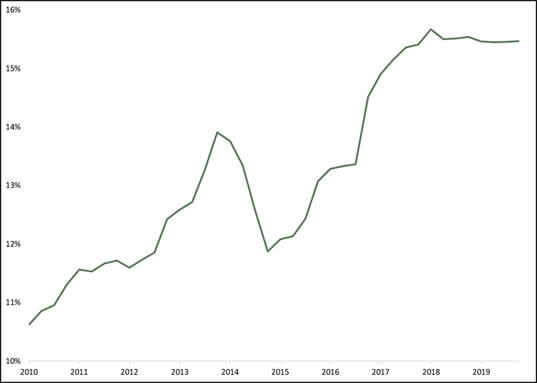

Figure 4: European Banks Core Tier 1 Capital Ratio

Source: Harris Associates

Figure 5: Oakmark International European Bank Capital Levels

As of March 17, 2020 | 2007 Core Tier 1 Ratio | 2019 Core Tier 1 Ratio |

|---|---|---|

BNP Paribas | 7.3% | 12.4% |

RBS | 7.3% | 16.2% |

Lloyds | 8.1% | 13.8% |

Intesa Sanpaolo | 5.9% | 14.1% |

Credit Suisse | 11.1% | 12.7% |

Given the spread of the virus within Italy, it appears Intesa will be the most impacted by this as it stands now. However, Intesa has the highest buffer to its required capital at ~460 bps, positioning the company to handle potential spikes in credit costs.

Widening value gap

As is often the case, share prices of our banks have fallen by approximately 35% over the last month. We believe a value gap is widening. When this occurs, you can expect us to purchase the names with the most upside to intrinsic value, essentially de-risking our portfolio.

Figure 6: Oakmark International Financial holdings valuation update

As of March 17, 2020 | Stock Price Total Return QTD | Price to Tangible Book Value FY1 | Price to Earnings Ratio FY1 | Dividend Yield 2020E |

|---|---|---|---|---|

BNP Paribas (EUR) | -45% | 0.4x | 5.5x | 10.6% |

RBS (?) | -45% | 0.5x | 9.2x* | 9.1% |

Lloyds (?) | -43% | 0.7x | 5.5x | 10.0% |

Credit Suisse (CHF) | -48% | 0.4x | 4.0x | 4.6% |

Intesa Sanpaolo (EUR) | -38% | 0.5x | 5.6x | 12.6% |

Source: Harris Associates estimates. *RBS P/E adjusted for one-time items.

When the uncertainty starts to wane in time, we believe the European financials can provide strong total returns for our shareholders. Thank you for your continued confidence and patience.

The holdings mentioned comprise the following percentages of the Fund's total net assets as of 12/31/2019:

Security | Oakmark International Fund |

|---|---|

BNP Paribas | 3.7% |

Credit Suisse Group | 3.5% |

Intesa Sanpaolo | 3.6% |

Lloyds Banking Group | 3.0% |

Royal Bank of Scotland | 1.5% |

Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks.

The Fund's portfolio tends to be invested in a relatively small number of stocks. As a result, the appreciation or depreciation of any one security held by the Fund will have a greater impact on the Fund's net asset value than it would if the Fund invested in a larger number of securities. Although that strategy has the potential to generate attractive returns over time, it also increases the Fund's volatility.

Investing in foreign securities presents risks that in some ways may be greater than U.S. investments. Those risks include: currency fluctuation; different regulation, accounting standards, trading practices and levels of available information; generally higher transaction costs; and political risks.

The information, data, analyses, and opinions presented herein (including current investment themes, the portfolio managers' research and investment process, and portfolio characteristics) are for informational purposes only and represent the investments and views of the portfolio managers and Harris Associates L.P. as of the date written and are subject to change and may change based on market and other conditions and without notice. This content is not a recommendation of or an offer to buy or sell a security and is not warranted to be correct, complete or accurate.

There can be no assurance that developments will transpire as forecasted. Actual results may vary.

This article first appeared on GuruFocus.