Oakmark International Small Cap Fund Buys 4 Stocks in 2nd Quarter

- By Margaret Moran

The Oakmark International Small Cap Fund (Trades, Portfolio) recently disclosed its portfolio updates for the second quarter of 2020.

Founded in 1995 and managed by portfolio managers David Herro (Trades, Portfolio), Michael Manelli and Justin Hance, the Oakmark International Small Cap Fund invests in a relatively small number of non-U.S. small-cap stocks (approximately 50 to 60). The fund aims to invest in securities that are trading at a discount to intrinsic value and show strong potential to increase value for shareholders.

Based on these criteria, the fund established new holdings in Elekta AB (OSTO:EKTA B), St. James's Place PLC (LSE:STJ), Equiniti Group PLC (LSE:EQN) and ALS Ltd. (ASX:ALQ) during the quarter.

Elekta

The fund invested in 1,681,000 shares of Elekta, impacting the equity portfolio by 1.45%. During the quarter, shares traded for an average price of 89.81 Swedish krona ($10.35).

Elekta is a Swedish clinical radiotherapy company that provides radiation therapy, radiosurgery, related equipment and clinical management for high-precision treatment of cancer and brain disorders.

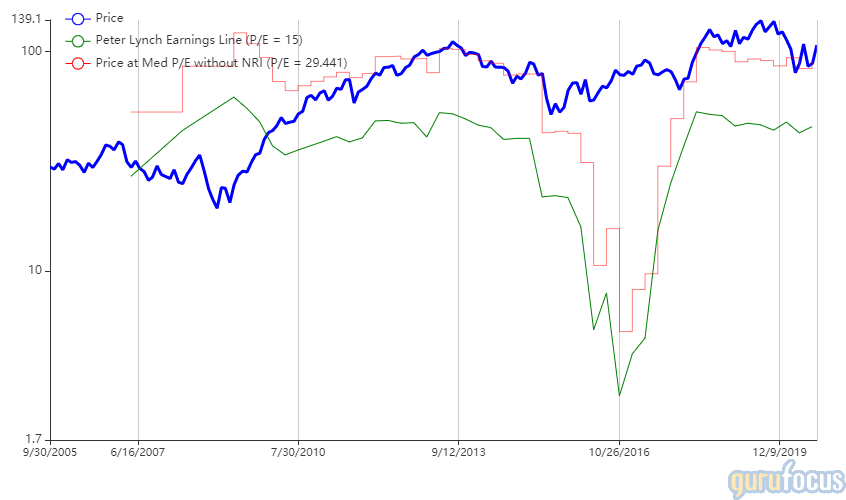

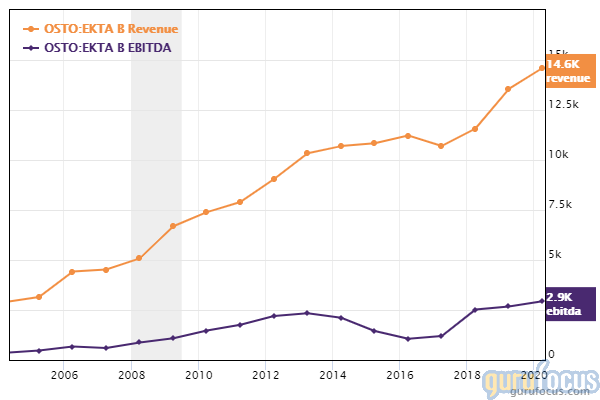

On Sept. 1, shares of Elekta traded around 108.45 krona for a market cap of 41.44 billion krona and a price-earnings ratio of 35.79. According to the Peter Lynch chart, the stock is overvalued but trading near its historical median valuation.

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 7 out of 10. The cash-debt ratio of 0.65 is lower than 67.08% of industry peers, but the Altman Z-Score of 2.26 indicates the company is not at high risk of bankruptcy. The company is growing quickly, with a three-year revenue growth rate of 10.8% and a three-year Ebitda growth rate of 34.6%.

St. James's Place

The fund also bought 1,014,000 shares of St James's Place, which had a 1.11% impact on the equity portfolio. Shares traded for an average price of 8.62 British pounds ($11.55) during the quarter.

St. James's Place is a UK-based wealth management company. With 115.7 billion pounds of client funds under management, it provides investment, retirement planning and other wealth management solutions.

On Sept. 1, shares of St. James's Place traded at about 9.80 pounds apiece for a market cap of 5.26 billion pounds and a price-earnings ratio of 18.88. According to the Peter Lynch chart, the stock is trading near its intrinsic value.

GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 4 out of 10. The trailing 12-month revenue per share is 1.68 pounds versus the TTM debt per share of 1.05 pounds and TTM earnings per share of 0.52 pounds, indicating that recent levels of income and overall profitability are unsustainable. This is supported by the net margin, which has dropped to a 10-year low of -4.18% as of the most recent quarter.

Equiniti Group

The fund established a position in Equiniti Group worth 1,076,000 shares, impacting the equity portfolio by 0.18%. During the quarter, shares traded for an average price of 1.52 pounds.

Equiniti is a British financial services and payments specialist company with a focus on technology, financial and administrative services. The company is rebranding to the "EQ" brand label.

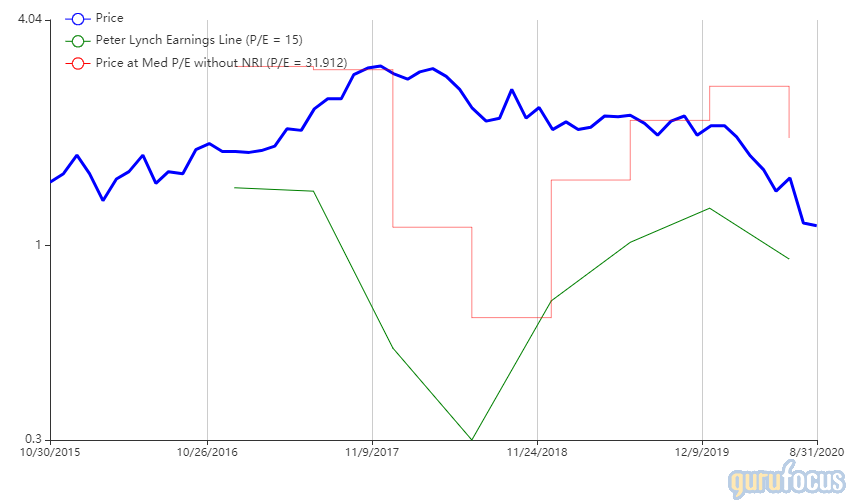

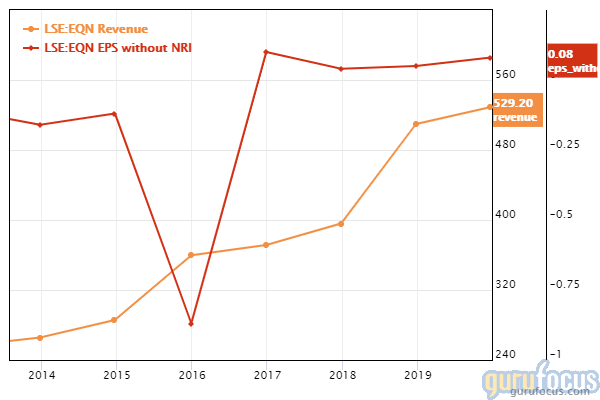

On Sept. 1, shares of Equiniti traded around 1.13 pounds for a market cap of 413.39 million pounds and a price-earnings ratio of 18.52. According to the Peter Lynch chart, the stock is overvalued but trading near its historical median valuation.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 4 out of 10. The interest coverage ratio of 1.28% and Altman Z-Score of 1.36 indicate the company could potentially face bankruptcy within the next two years. The top line is growing with a three-year revenue growth rate of 7.6%, while the three-year earnings per share without non-recurring items growth rate stands at -4%.

ALS

The fund also bought 323,000 new shares of ALS after selling out of its previous investment in the company during the second quarter of 2018. The trade had a 0.14% impact on the equity portfolio. Shares traded for an average price of $6.60 during the quarter.

Based in Australia, ALS is a global provider of laboratory testing, inspection, certification and verification solutions for labs, industrial buildings, drugs and consumer products, among others.

On Sept. 1, ALS shares traded around $8.68 for a market cap of $4.21 billion and a price-earnings ratio of 33.07. According to the Peter Lynch chart, the stock is trading above its intrinsic value.

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 7 out of 10. The interest coverage ratio of 7.7 and Altman Z-Score of 2.29 indicate that the company is not likely in danger of bankruptcy within the next two years. On average, the return on invested capital exceeds the weighted average cost of capital in recent years, indicating overall profitability.

Portfolio overview

During the quarter, in addition to establishing the four new positions above, the fund sold out of its investment in Dignity PLC (LSE:DTY) and added to or reduced several other positions for a turnover rate of 8%.

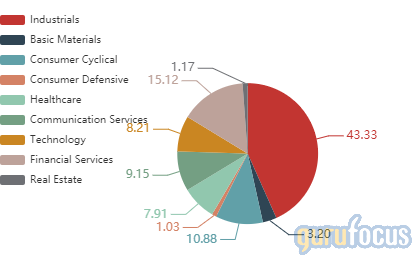

As of the quarter's end, the fund's top holdings were Konecranes Oyj (OHEL:KCR) with 4.49% of the equity portfolio, Duerr AG (XTER:DUE) with 4.2% and Julius Baer Gruppe AG (XSWX:BAER) with 3.5%. In terms of sector weighting, the fund was most invested in industrials, followed by financial services and consumer cyclical.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

The SPAC Bubble: Buy Signal or Warning Sign?

Top 2nd-Quarter Trades of Lee Ainslie's Maverick Capital

Julian Robertson's Top 2nd-Quarter Trades

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.